Hollywood Restructuring and the Writers and Actors Strikes of 2023

Hollywood Restructuring and the Writers and Actors Strikes of 2023

UCLA Anderson Forecast director Jerry Nickelsburg assesses the economic impact

March 12, 2024

- The 2023 Hollywood writers and actors strikes caused speculation about the extent to which local and state economies were affected

- UCLA Anderson Forecast director Jerry Nickelsburg cautions against comparing the strike year to the pandemic “recovery” year of 2022

- Nickelsburg applies two methodologies to analyze the latest available data for an estimate of the direct cost of the strikes

Dual strikes in Hollywood — writers and then actors — shut down much new film and television production from April to early November 2023. Throughout the strike period there were speculations, sometimes offered with a seriousness with regard to their certainty, about the economic impact. Indeed, everyone wanted to know on a daily basis the impact on the Los Angeles economy and, by extension, the California economy.

The answer is complicated. For example, 2022 was a recovery year from the dearth of production during the pandemic years of 2020 and 2021. Should the comparison be between 2023 when the strikes were going on and 2022 when the industry was producing additional content post-pandemic? That would certainly inflate the economic impact. But what about using a more normal year, like 2019, as a comparison? From then until now, the entertainment industry has been adjusting to digital media, streaming and business models that were not generating the required returns to continue as before. This has resulted in a downward trend in the production of film and television.

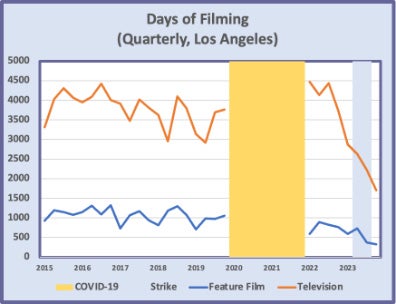

Chart 1 illustrates the complexity of the issue. Notice the steep drop in the number of days of filming in both television and feature films in 2022, a year that should have seen an increase as studios recovered lost content because of the pandemic and as they prepared for what might be an attenuated labor action. Clearly, there is not an obvious baseline from which to measure the economic impact of the labor actions.

This essay reports two methods to ascertain a rough order of magnitude of impact, conditioned on the fact that 2024 data will be important in refining, and likely lowering, the estimates herein. The findings from both methods suggest a to-date impact of approximately $1.5 billion, or 0.16% of an almost trillion-dollar Los Angeles economy, and 0.04% of the almost $4 trillion California economy.

The first method employed in this analysis uses the number of days of filming in 2023 as a percentage of the expected non-strike number of days of filming and applies that to double the value of productions subsidized by the State of California. The estimate will be based on extrapolating the trends pre-pandemic. This is, admittedly, an assumption, particularly when it comes to the estimate of the total value of expected production; but it turned out to be similar to the result of the other method. The second method estimates the California GDP value per payroll employee and applies that estimate to the reduction in employees during 2023, adjusting for non-payroll employment in Hollywood.

One method for estimating the reduction in the number of days of filming in Los Angeles from trend is to estimate the trend from pre-2020 data and extrapolate to 2023. This will likely result in too high an estimate with a linear trend because the restructuring accelerated over the last five years. More realistic is a non-linear trend, and this was also estimated on pre-2020 data. To translate this to dollars requires putting a dollar figure on film and television recording for 2022. From official reports, we find that $4.4 billion in production was subsidized in 2022. Some of that filming was outside Los Angeles and some filming was without subsidy. Just to get a rough order of magnitude, suppose half of the total value of productions were associated with the subsidy. Those that were not were likelier to be smaller, less expensive productions, and were likelier to be more numerous than those that were.

Using the trends to adjust from 2022 spending to trend 2023 spending, and then taking the difference between trend days of filming and actual days of filming, yielded an estimate of the economic impact. With a simple linear trend, the direct impact was estimated at $2.25 billion. Using the more realistic non-linear trend, representing accelerated restructuring of the industry relative to the 2015 to 2019 period, reduced this impact to an estimated $1.59 billion.

A second methodology is to look at the average amount of GDP generated per payroll employee in film and television production. This is available from the California Employment Development Department’s employment statistics and the U.S. Bureau of Economic Analysis GDP statistics. The average in California for 2022 was $147,200. The 2019 to 2023 drop in sectoral GDP was estimated to be approximately $400 million — significantly below the estimates reported in the press. The data for 2023 payroll employment show a drop of only 3% in jobs between the two reference years. Because many jobs in Hollywood are not payroll jobs, this estimate is likely to be somewhat low. A 2012 estimate of the number of independent contractors compared to each payroll employee was 0.67. Since those independent contractors are on average less-than-full-time employees (for example, extras and part-time actors), if we assign $20,000 of the $147,000 to them and assume all of them were unemployed for all of 2023, the estimated economic impact is $1.4 billion.

There are two important caveats. The first is the multiplier effect. Not all of the lost revenue represents lost consumption. Striking workers draw down savings and continue to spend, albeit at a lower rate, and there are leakages outside of California. Because of the nature of the industry, with fluidity of production across state and national borders, and with residences generally not associated with production away from the two centers of entertainment, Southern California and New York City, it is difficult to infer how much if any net impact the strike had from standard multiplier analysis.

The second caveat is that we only have data through 2023 and do not have the 2024 numbers to use in this evaluation. To the extent that production was postponed into 2024 because of the uncertainty about when the strike would end and the closely following holiday season, it might be the case that catch-up production will offset some of the projected losses presented here. For that we need another year or two of data to refine the estimates. Consider the following two scenarios: In the first, production stays at 2023 levels in 2024 and 2025. In that case, 2023 was a “normal” post-restructuring year and the losses associated with the labor actions were only a result of activity that might have taken place had there been a more gradual transition to 2024 levels. In the second scenario, suppose 2024 and 2025 production returns to 2022 levels. In that case, most of the dip in production in 2023 can be attributed to the two strikes.

Using the data available, we find that the direct cost of the strike is likely to be in the $1.4 billion to $1.6 billion range, with an outside estimate of $2.3 billion. Our expectation is that these numbers are high, in the sense that additional data ought to confirm that part of the estimated cost was from a restructuring of the entertainment business. Therefore, we can conclude that the $3 billion-plus-swag is just that, a swag, and the impact on both the Los Angeles and California economies was quite small in the aggregate, even as it was individually large and difficult for some.

Jerry Nickelsburg is faculty director of the UCLA Anderson Forecast and an adjunct professor of economics.