Fink Credit Pitch Competition

Save the Date

November 1, 2024

(In-Person, UCLA Anderson Campus)

The Fink Credit Pitch Competition is one of the premier MBA pitch competitions in the nation. Talented students from top business schools gather at UCLA Anderson to pitch their best credit investment idea to a panel of distinguished industry judges. The one-day event includes opportunities for students and firms to network and participate in formal recruiting activities.

Sponsoring firms have the opportunity to present to and network with some of the brightest MBA students in the investment management space. Firms are invited to send recruiters and judges to the event and will also receive student resume books.

Click the tabs below to learn more about how students and firms can participate. For any questions, please email creditpitch@anderson.ucla.edu.

TEAMS

- Composition: The event is geared towards students who are interested in recruiting for summer internship positions at asset management firms. Teams should consist of 3-4 students and must meet the following criteria:

- At least one team member must be a woman

- A maximum of one team member can be a second-year student

- A majority of the team should be MBA students, but students who are pursuing asset management relevant graduate degrees (ie: Master of Financial Engineering, Master of Finance, etc.) may also participate. Teams can contact the event organizers if they have questions about their degree program.

- Only one team may represent each university. It is highly encouraged that each school coordinates amongst themselves to determine the team they would like to send. If more than one team per school applies to compete, then the organizers will select one team.

- Please note, submission of an application is not a guarantee that a team will be selected to participate in the competition.

- Submission and Notification: Teams will need to register using via a registration link. Teams will be notified of decisions shortly thereafter and will be sent a link to pay the registration fee of $275.

- Team Names: All teams will be assigned a Greek letter team name by the competition organizers to ensure that school affiliation is kept anonymous from the judges.

- Substitutions: Accepted teams may only change team members on a case-by-case basis, with permission from the competition organizers

COMPETITION DETAILS

- Security Selection: Teams will be pitching one security [long or short]. Teams must pick a corporate security that is credit or credit-based. The pick should be a specific debt-focused instrument, not a company/entity in general. Teams need to have a target price [upside/downside].

- Pitch Content: Pitch decks should include fundamental analysis of the bond issuer, bond specific investment considerations, risk vs. return analysis, and a target price along with a buy/sell/hold recommendation.

The most successful teams include the following content: investment thesis/catalyst, business overview (how do they make money, why do they exist, competitive advantage, important industry trends, market share shifts, disruption, etc.), comps/relative valuation, cap table, forecasted financials, relevant key ratios (Debt/EBITDA, interest coverage, etc.), liquidity of the specific issue, organization structure, discussion of company management, historical capital allocation strategy, risks to the thesis.

- Pitch Format: All pitches must be in PowerPoint format on a pre-designed template that will be provided by the competition organizers. There are no slide count restrictions, but strict time restrictions will apply (see below).

- Pitch Deadline: All pitch decks must be submitted by the stated deadline. Pitches submitted after the deadline will not be considered.

- Team Presentations: Presentations will occur in two rounds – a preliminary round and a final round. The presentation order for teams will be randomly assigned for both rounds.

-

- Preliminary Round: Teams will be randomly divided into divisions and each division will present to a group of judges. Each team will have up to 10 minutes to present, followed by 10 minutes of Q&A with the judges. Teams will not be allowed to attend other teams' pitches during the preliminary round.

-

- Final Round: Teams selected by the judges to move on to the final round will have up to 10 minutes to present, followed by 15 minutes of Q&A with the judges. The same security must be pitched for both rounds. Teams that do not progress to the final round are highly encouraged to attend the final round pitches.

Each presentation will be officiated by a member of the UCLA Anderson School of Management community. Time limits will be strictly enforced by the official. All team members are expected to contribute to the presentation and Q&A.

- Final Round: Teams selected by the judges to move on to the final round will have up to 10 minutes to present, followed by 15 minutes of Q&A with the judges. The same security must be pitched for both rounds. Teams that do not progress to the final round are highly encouraged to attend the final round pitches.

- Judging: All presentations will be judged by industry professionals. Areas of evaluation will include: quality of analysis, risk vs. return analysis, presentation skills, Q&A expertise [concise and clear responses, participation from all members of the team] and strength of investment thesis [how differentiated is it, thesis well supported by contextual information, understandable and executable].

AWARDS AND PUBLICITY

- Awards: Announcement of the winners will be made at the awards ceremony immediately following the conclusion of the final presentations. Cash prizes totaling $6,000 will be awarded to the top three teams:

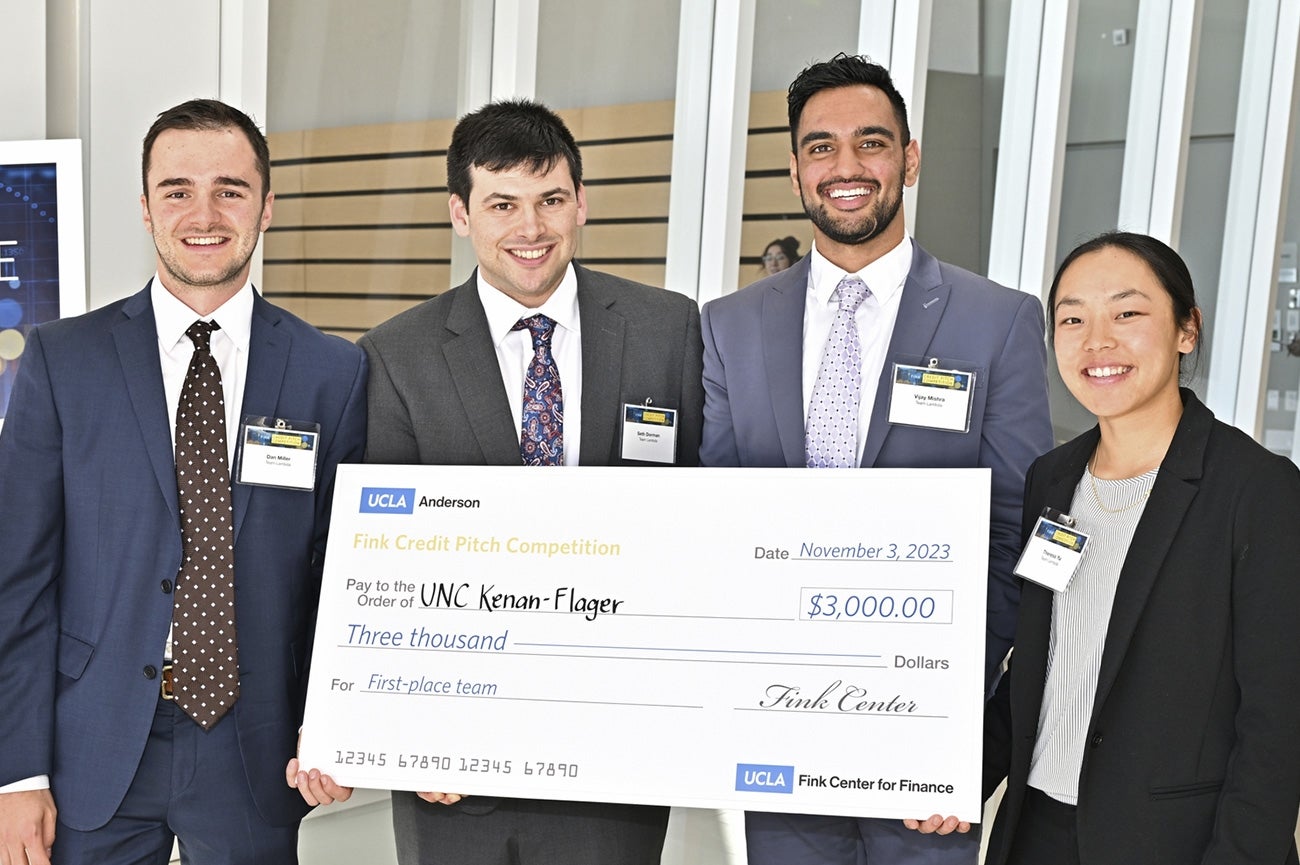

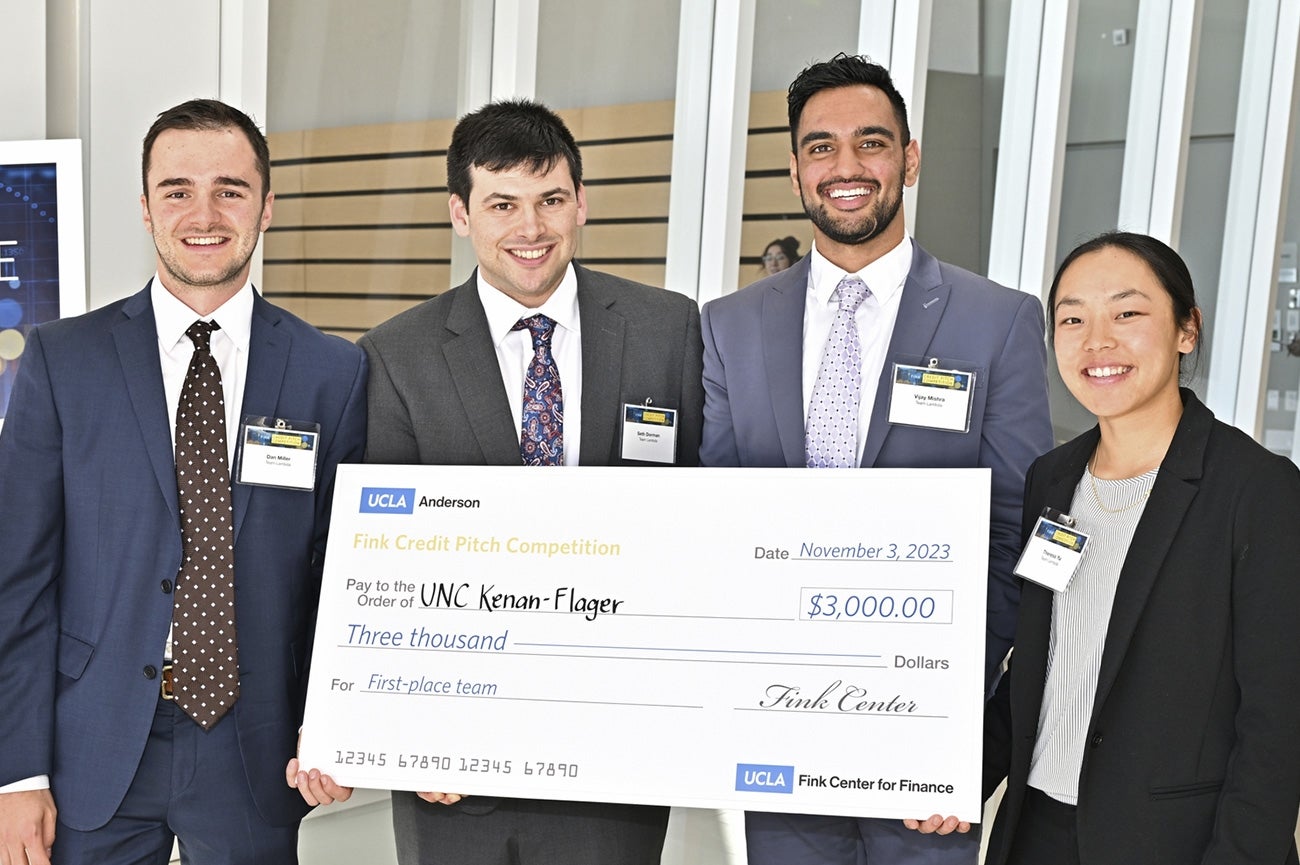

1st Place: $3,000

2nd Place: $2,000

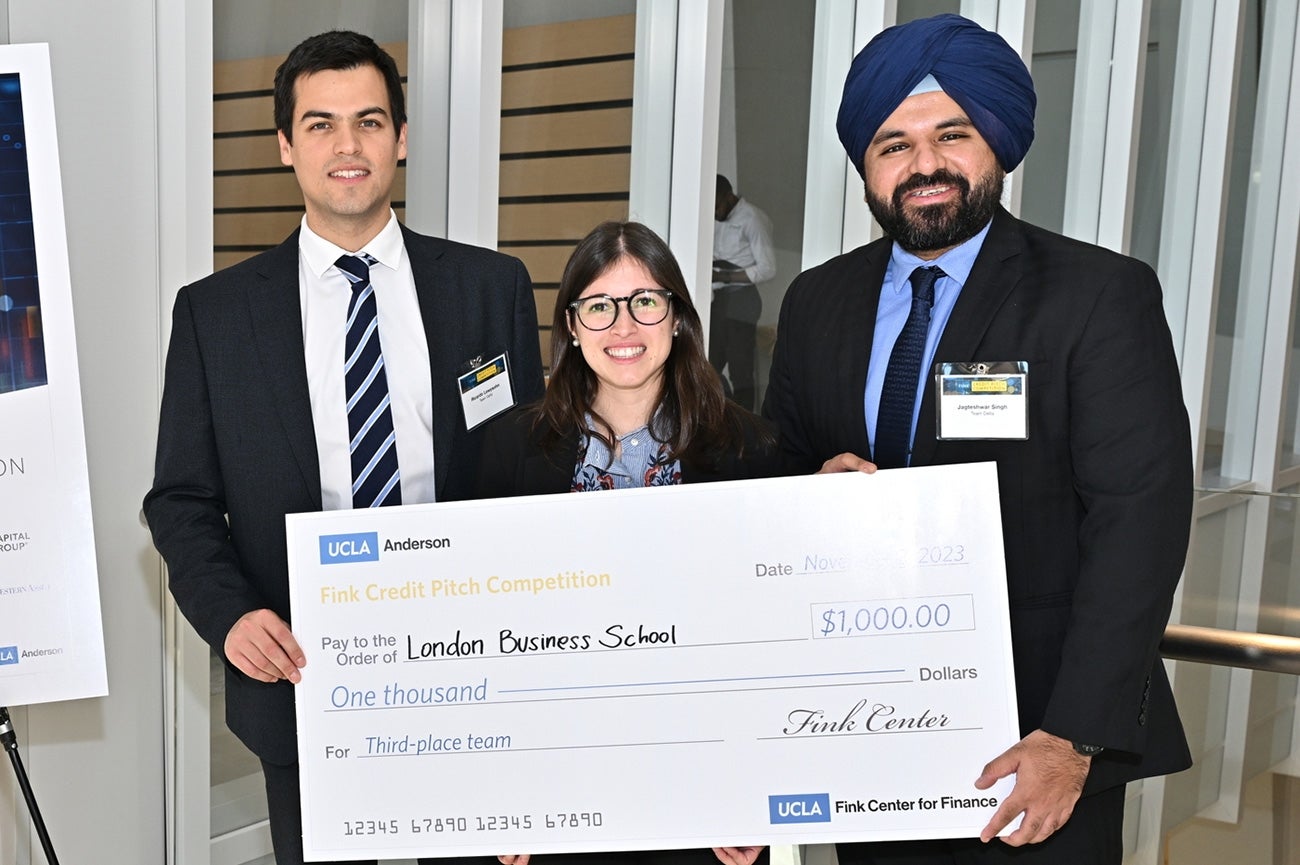

3rd Place: $1,000Winners will be provided paperwork to fill out immediately after the competition to facilitate their payments. All payments are contingent on the receipt of completed paperwork in a timely manner and must adhere to UCLA payment guidelines. *Prizes are subject to tax

- Publicity: All team members agree to allow their names and likenesses to be used in press materials.

THE HONOR SYSTEM

- No External Aid: No outside help will be allowed from anyone in preparing the materials and presentation; help can be solicited from industry contacts to better analyze data.

- Research Integrity: All data sources are fair game, including the Internet and any proprietary quantitative or fundamental models developed in advance. However, proper attribution must be provided (i.e., sources must be clearly marked on each slide).

- Team Firewalls: It is expected that teams will fully respect one another's privacy, and that team members will neither seek nor provide information to anyone outside their own team.

- Violations: Any violation of these rules constitutes grounds for disqualification and notification of the Academic Services dean at the offending team’s graduate MBA program.

Past Participating Schools

Carnegie Mellon University, Tepper School of Business

*Columbia Business School

*Cornell SC Johnson College of Business

Duke Fuqua School of Business

Dartmouth College, Tuck School of Business

Haas School of Business, University of California Berkeley

*London Business School

McDonough School of Business, Georgetown University

Northwestern University Kellogg School of Management

NYU Stern School of Business

Ross School of Business, University of Michigan

*UCLA Anderson School of Management

*University of Chicago Booth School of Business

*University of North Carolina, Chapel Hill

University of Texas at Austin, McCombs School of Business

*University of Virginia, Darden School of Business

USC Marshall School of Business

*Wharton School of the University of Pennsylvania

Yale School of Management

*Denotes participation in 2023

Past 1st Place Winners

2023-2024 - University of North Carolina, Chapel Hill, Kenan-Flagler Business School

2022-2023 - University of Chicago Booth School of Business

2021-2022 - Wharton School of the University of Pennsylvania

2020-2021 - University of Chicago Booth School of Business

2019-2020 - USC Marshall School of Business

2018-2019 - Columbia Business School

2017-2018 – University of Chicago Booth School of Business

2016-2017 – Duke Fuqua School of Business

2023 Participating Firms

The Fink Credit Pitch Competition would not be possible without the sponsorship and participation of the firms below in networking events, recruiting activities, and judging.

To learn more about sponsorship opportunities, contact Alina Sarkissian at alina.sarkissian@anderson.ucla.edu.

2023 Competition Winners

Credit Pitch Competition Videos

Preparing for the Business World