Mortgage Default Risk Index (MDRI)

Real-time, Google search-based mortgage default index

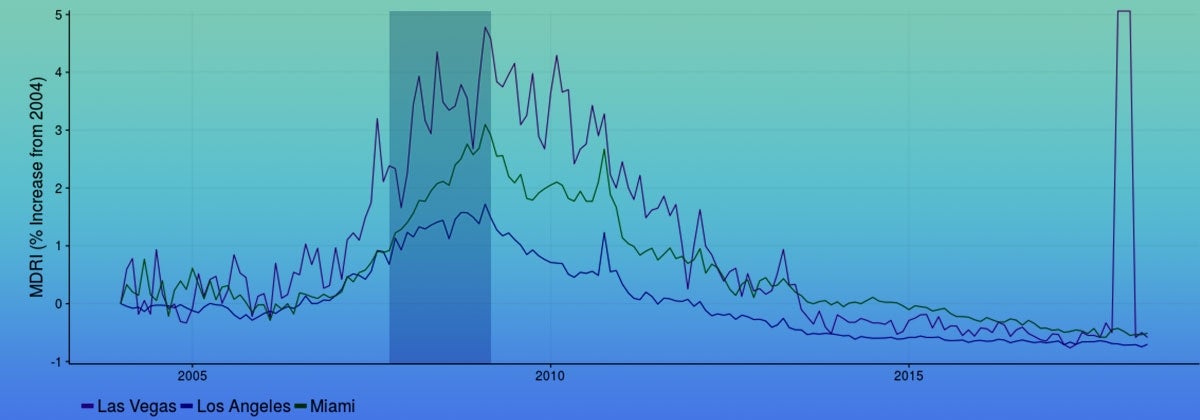

Using extensive real-time and broad-based data from Google, the MDRI compiles information from Internet search query for terms such as "foreclosure help" and "government mortgage assistance" to formulate the index. The MDRI uses a much larger number of observations than traditional indexes and accordingly can be estimated for many metropolitan areas and at high frequencies. The ability of the MDRI to predict such outcomes as housing returns, mortgage delinquencies, and subprime credit default swaps has been demonstrated in peer-reviewed academic research (see, "Mortgage Default Risk: New Evidence from Internet Search Queries", Journal of Urban Economics, Volume 96, November 2016, Pages 91-111).

The MDRI is updated regularly and published by the UCLA Ziman Center for Real Estate in the UCLA Anderson School of Management. It was developed by Professors Marcelle Chauvet, Stuart A. Gabriel, and Chandler Lutz.

2019

Q1 - Mortgage Default Risk Stays Low with Strong Labor Markets

U.S. mortgage default risk as measured by the Mortgage Default Risk Index (MDRI) remains at all-time lows despite recent dampened house price growth: Households are benefiting from low unemployment and a strong labor market as well as lower debt, relative to home prices, compared to the 2000s boom and bust.

Q2 - Increasing Wages and Employment Keep Mortgage Default Risk Low

U.S. Mortgage Default Risk as measured by the Mortgage Default Risk Index continued to remain at historic lows as increasing employment, higher wages, and declines in interest rates have buttressed borrowers’ ability to repay mortgage debt. These trends are likely to continue during this low interest rate, high employment growth environment.

Q3 - Low Mortgage Default Risk Levels Continue Alongside Solid Economic Fundamentals

The Mortgage Default Risk Index (MDRI) remains at the lower end of its historical range, corresponding to the lowest levels of mortgage defaults and foreclosures since the Great Recession. Overall, strong labor markets and domestic fundamentals, even in the face of rising trade tensions and slower global growth, have contributed to households' ability to repay mortgage debt, especially as many borrowers have locked in historically low interest rates.

Q4 - U.S. Mortgage Default Risk Remains Low with Strong Labor Markets

As unemployment has fallen to historic lows, the U.S. Mortgage Default Risk Index (MDRI) has stayed at the low end of its range, signaling limited risk of borrower default among U.S. households. Geographically across U.S. cities, mortgage default risk as measured by the MDRI also is limited.

2018

Q1 - Robust Housing Market Propels Mortgage Default Risk Lower

As the U.S. economy and housing markets have continued to pick up steam, household Mortgage Default Risk (MDRI) has fallen 9.1 percent over the last year. Mortgage Default Risk is also low across U.S. housing markets as the impacts of the Great Recession have nearly dissipated.

Q2 - Mortgage Default Risk Low with U.S. Economy at Full Strength

The U.S. Mortgage Default Risk Index (MDRI) has fallen 10 percent over the last year and is near its post-Recession lows as the U.S. housing market continues to gain steam. Further, local housing markets that suffered during the Great Recession, like Miami, have completely recovered and Mortgage Default Risk in these areas is similar to the broader U.S. overall.

Q3 - Strong Labor Market leads U.S. Mortgage Default Risk to Post-Recession Lows

Although U.S. house prices have softened in some markets, Mortgage Default Risk as measured by the Mortgage Default Risk Index (MDRI) is at its lowest point since the Great Recession. These low levels of Mortgage Default Risk reflect healthy labor markets, large employment gains, and robust wage growth. Falling house prices in some markets are currently not impacting mortgage defaults as price declines are associated with affordability and interest rate concerns for new borrowers, while existing borrowers mostly locked in lower mortgage rates and maintain a strong ability to repay due to robust labor markets.

Q4 - U.S. Mortgage Default Risk Remains Low

U.S. Mortgage Default Risk as measured by the MDRI indicator remained low through 2018Q4 due to a strong labor market. Overall, weaknesses related to the recent downturn in equities, increases in interest rates, and trade shocks have not permeated to the household sector. Thus, there has been no upward shift in Mortgage Default risk.

2017

Q1 - Mortgage Default Risk Index Shows Default Risk at All Time Lows

The Mortgage Default Risk Index (MDRI) shows that U.S. Household Mortgage Default Risk decreased 14 percent over the last year with cities across the U.S. hitting post-recession lows. Declines in Household Mortgage Default Risk have been largest in Miami, Dallas, and Chicago. The overall low levels of Mortgage Default Risk highlight the strength of the U.S. housing and labor markets as the current economic expansion continues into its 8th year.

Q2 - U.S. Mortgage Default Risk Continues Downward Trend

The U.S. Household Mortgage Default Risk Index (MDRI) fell nearly 17 percent over the last year as the economy and housing market continued to pick up steam. Recent increases in interest rates by the Federal Reserve do not appear to have affected Mortgage Default Risk at the household level. Cities that suffered extreme downturns during the 2000s crisis, such Las Vegas and Phoenix, continue to experience above average declines in Mortgage Default Risk as their housing markets recover from their 2011 lows.

Q3 - U.S. Mortgage Default Risk Stable at All Time Lows

The MDRI shows that U.S. Mortgage Default Risk has decreased 15 percent over the last year while flattening relative 2017Q2. Yet local housing markets that experienced extreme volatility during the 2000s, such as Las Vegas, Miami, Phoenix, and Los Angeles, continue to benefit from a downward trend in Mortgage Default Risk. Overall, the low levels in U.S. Mortgage Default are presently stable as job growth remains robust and as the Federal Reserve considers increasing interest rates and reducing its balance sheet.

Q4 - U.S. Mortgage Default Risk Low with Strong Economic Growth

Mortgage Default Risk nationwide has decreased 11.8 percent over the last year as the economy and housing market have continued to gain steam. The housing markets hit hardest during the Great Recession, such as Miami and Phoenix, continue to experience declines in Mortgage Default Risk as these housing markets have nearly recovered completely from their previous lows.

What is MDRI?

What is MDRI?

Real-time, Google search-based mortgage default index

The MDRI - Mortgage Default Risk Index - is a unique search query-based index of mortgage default risk in key U.S. housing markets. Using extensive real-time and broad-based data from Google, the MDRI compiles information from Internet search query for terms such as "foreclosure help" and "government mortgage assistance" to formulate the index. The MDRI uses a much larger number of observations than traditional indexes and accordingly can be estimated for many metropolitan areas and at high frequencies. The ability of the MDRI to predict such outcomes as housing returns, mortgage delinquencies, and subprime credit default swaps has been demonstrated in peer-reviewed academic research (see, "Mortgage Default Risk: New Evidence from Internet Search Queries", Journal of Urban Economics, Volume 96, November 2016, Pages 91-111).

The MDRI was developed by Marcelle Chauvet, Stuart A. Gabriel, and Chandler Lutz and is updated regularly and published by the UCLA Ziman Center for Real Estate in the UCLA Anderson School of Management.

Market Snapshot of 20 Cities

MDRI Performance During the Great Recession

At the peak of the business cycle in December 2007, the MDRI identified San Diego, Las Vegas, Los Angeles, and Phoenix as the cities most at-risk of experiencing widespread mortgage defaults. Below is a table that ranks the 20 Case-Shiller by growth in their Mortgage Default Risk Index (MDRI) from January 2006 to December 2007:

| Rank | City |

| 1 | San Diego |

| 2 | Detroit |

| 3 | Phoenix |

| 4 | Los Angeles |

| 5 | Miami |

| 6 | San Francisco |

| 7 | Denver |

| 8 | New York |

| 9 | Tampa |

| 10 | Cleveland |

| Rank | City |

| 11 | Washington DC |

| 12 | Minneapolis |

| 13 | Chicago |

| 14 | Boston |

| 15 | Las Vegas |

| 16 | Atlanta |

| 17 | Seattle |

| 18 | Dallas |

| 19 | Charlotte |

| 20 | Portland |