Summer 2023 Survey

A Mixed CRE Development Trajectory

Adjunct Professor of Economics, UCLA Anderson School

Senior Economist and Director, UCLA Anderson Forecast

In the six months since the last Survey, interest rates and cap rates have bumped up, and the recession that some said was supposed to happen moved further and further into the future. The Summer 2023 Allen Matkins/UCLA Anderson Forecast California Commercial Real Estate Survey not surprisingly reflects the appropriate caution engendered by these mixed signals. Nevertheless, with an economy that is still growing, new bright spots have appeared on the horizon. The empirical evidence on the economic trajectory for 2023 indicates that whether the economy enters a slow growth period or mild recession later in the year, it will be milder in California than for the rest of nation. This has led to more optimism about both new home development and associated retail development. Though there is more optimism, the Summer 2023 Survey panelists across all types of commercial real estate and regions of California indicated they are facing a more challenging financial landscape with required equity percentages and investment return (IRR) hurdle rates expected to increase over the coming three years.

Statistical forecast analysis has as its basis the proposition that past statistical relationships hold into the future. A knowledge of those correlations, current data and perhaps some assumptions about data not yet known, lead to the forecast. In addition to the summary measures of developer sentiment reported here, the Survey has a rich set of questions such that, with past trends in the Survey’s indexes, we can now infer a more nuanced turn in commercial real estate markets.

The Allen Matkins/UCLA Anderson Forecast California Commercial Real Estate Survey compiles the views of commercial real estate developers, owners, and investors with respect to markets three years hence. The three-year time horizon was chosen to approximate the average time a new commercial project requires for completion (though projects with significant entitlement and/or environmental issues often take much longer). The panelists’ views on vacancy and rental rates are key ingredients to their own business plans for new projects, and as such, the Survey provides insights into new, not yet on the radar, building projects and is a leading indicator of future commercial construction. For example, if a developer were optimistic about economic conditions in Silicon Valley’s office market in 2026, then initial work for a new project with an expected ready-for-occupancy date of 2026 — a business plan, preliminary architecture, and a search for financial backing — would have to begin no later than the latter part of 2023. Although optimism does not always translate into new construction projects, this sentiment is usually a prerequisite for it.

Office Space Markets

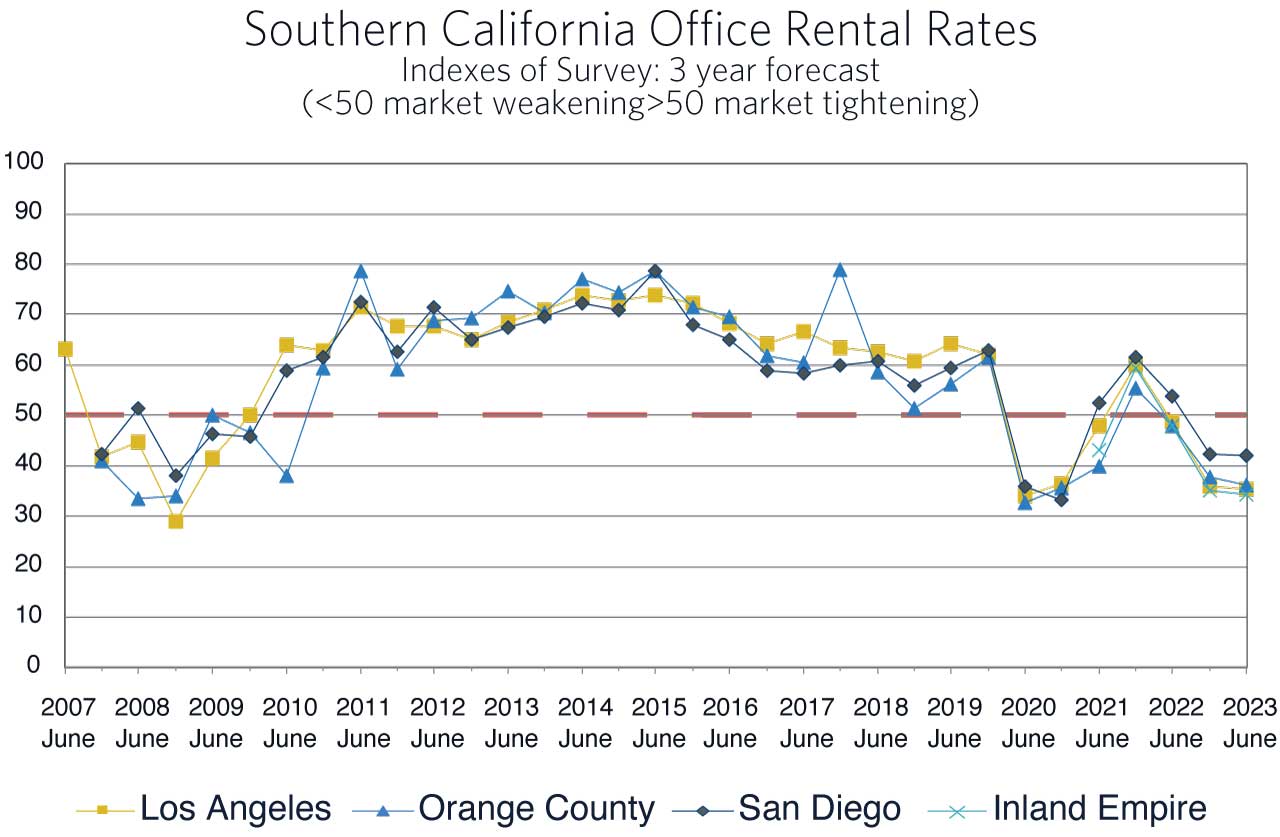

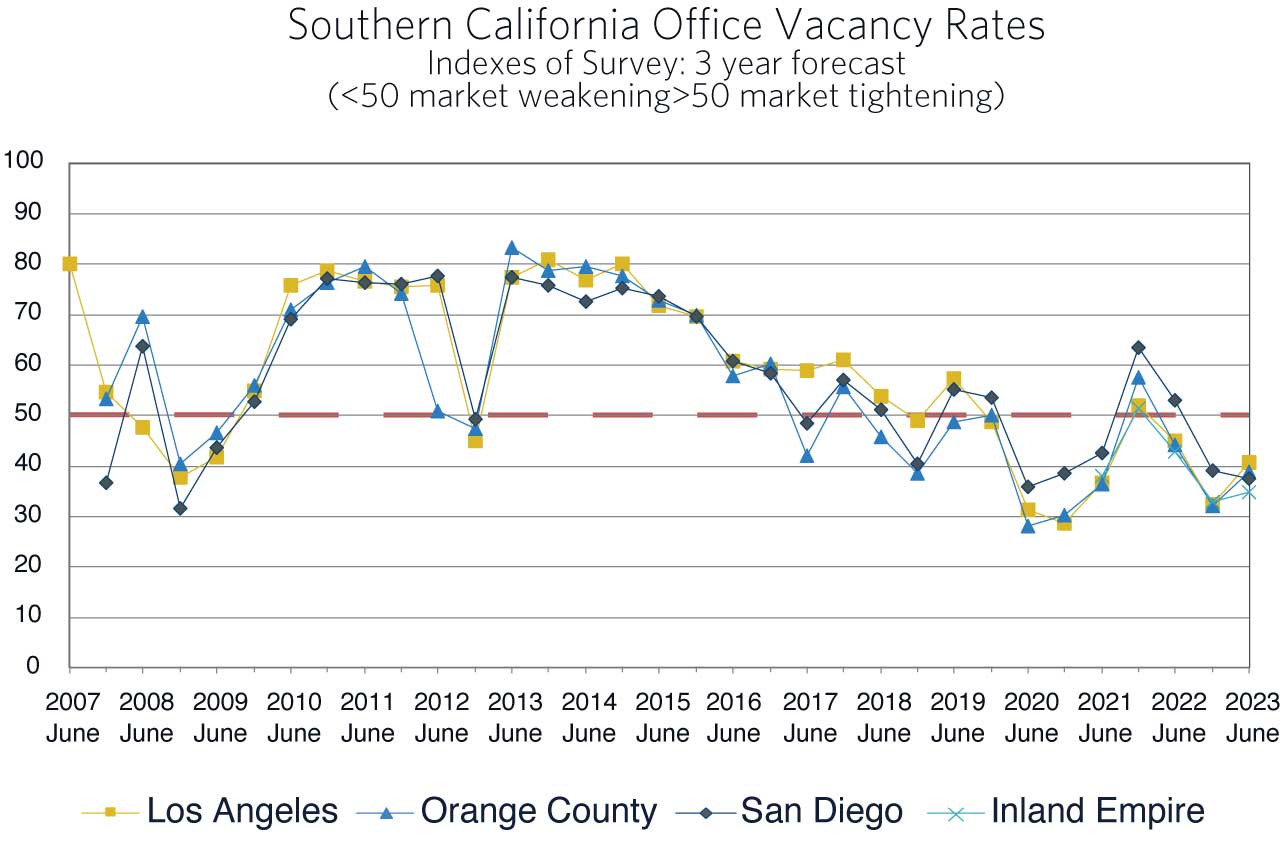

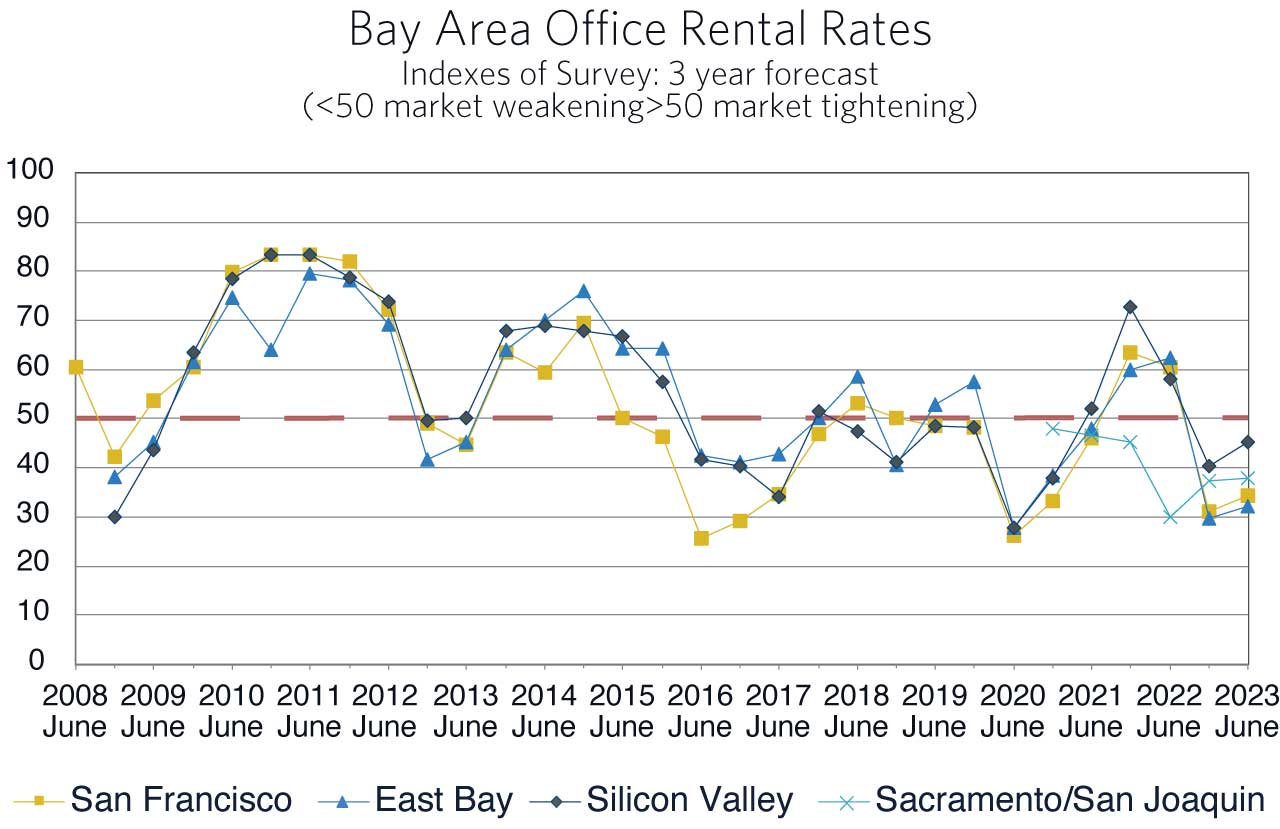

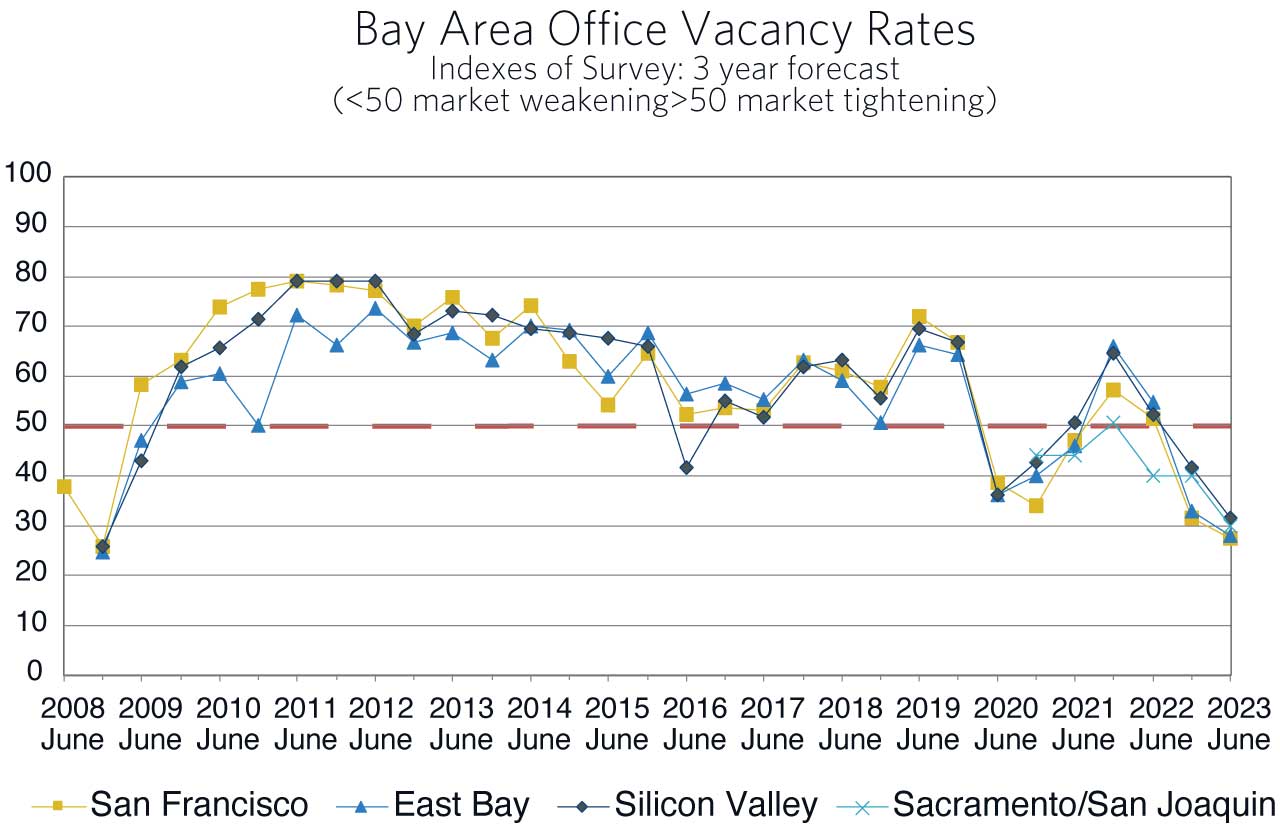

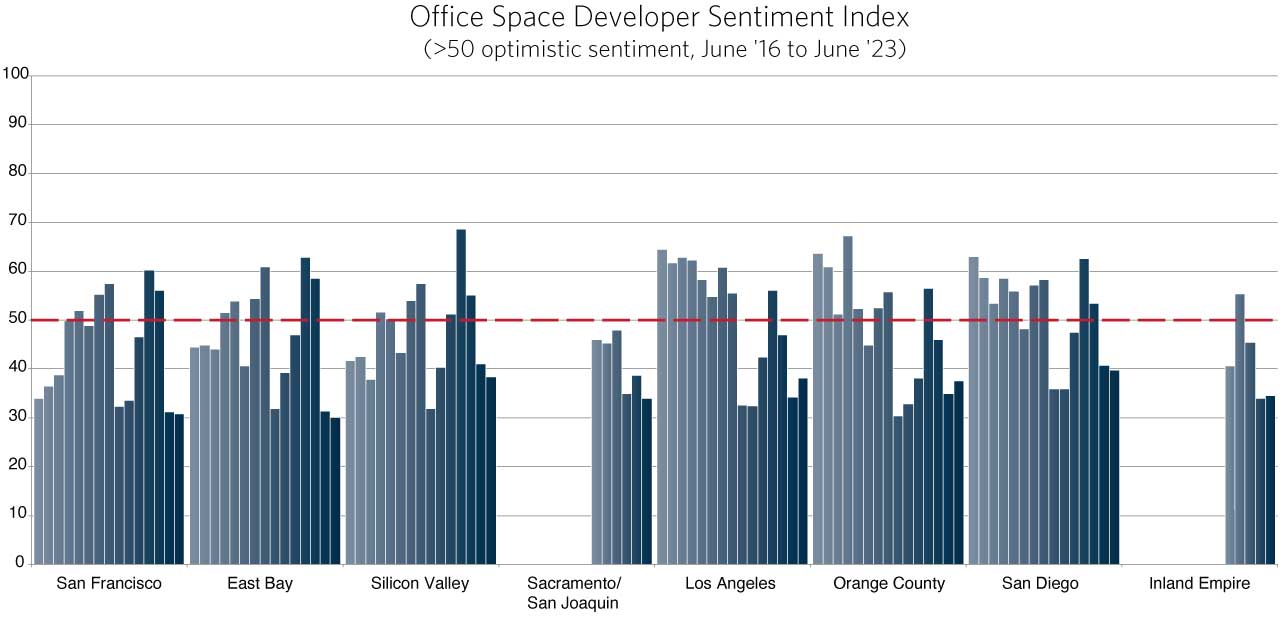

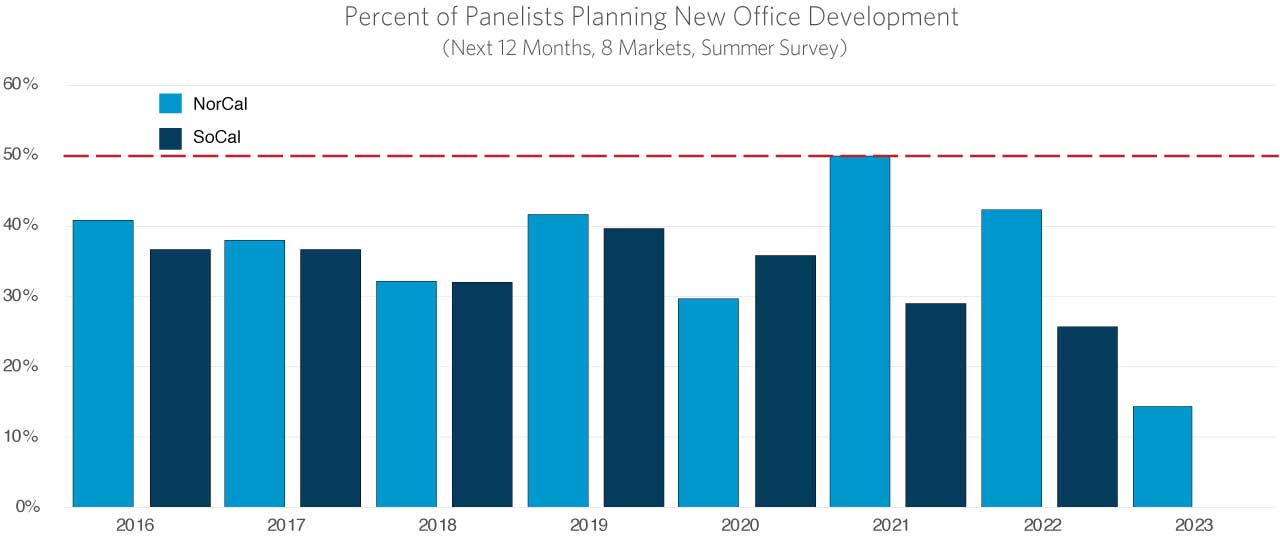

For developers in the office sector, the rationalization of existing office space and a return-to-the-office are going to be key elements in deciding where and when to invest. In 2022, sentiment turned positive as developers were seeing the beginning of a return to the office and that view continued through the summer. Over the last year, that sentiment has waned and in each of the eight markets surveyed it is decidedly negative (Chart 1). On average, participants in each panel expect both rental rates and occupancy rates to weaken in the coming year and they do not expect a full recovery to current levels before the end of 2026. This portends less new office construction, particularly in the year to come (Chart 2).

Over the next three years, approximately half the panelists in both Northern and Southern California expect office market economics to deteriorate. In particular, they are expecting the demand for office space to remain less than supply even as some return-to-the-office takes place. In Northern California only 14% of the panelists have plans to start a new office project in the next twelve months and none are going to begin more than one new project. In Southern California none of the panelists have plans for any new development in the next twelve months (Chart 2).

Why the pessimism? It is not because office using employment is shrinking. Indeed, payroll employment in office using sectors has grown steadily over the past year. This includes the professional, scientific, and technical services sector, a tech centric sector important for the Bay Area. However, the kinds of jobs that fueled a boom in office leases pre-pandemic, are also those most amenable to remote work. This has given rise to vacancy rates of 30% or more in San Francisco and downtown Los Angeles.

Current Federal Reserve policy is to cool the economy and, at least in the office space development sphere, it has succeeded. In addition to very high vacancy rates, financial markets are more challenging today and a near term easing of lending conditions is not expected. Office building loans facing refinancing confront a rebasing of asset values and depending on the quality of existing leases, potential defaults. The UCLA Anderson Forecast presented two scenarios of future Fed policy. In the first, the Federal Reserve’s aggressive increases in interest rates induces a third quarter 2023 recession. In this scenario private office using payroll employment contracts by 0.1% from the fourth quarter of 2022 to the fourth quarter of 2023 and then grows by 5.1% by the fourth quarter of 2025. Were the Fed to moderate interest rate increases as in the alternative scenario, private office-using payroll employment grows by 0.9% in 2023 and expands by 6.9% the end of 2025. The higher financing hurdles, the unknown future asset values, a potential swing from -0.1% to +6.9% in demand, and uncertainty surrounding the rapidity of more complete return-to-work and the form it will take explains the very pessimistic office development panels. Given the overhang of redundant office space, the financial work-outs yet to come, and the uncertainty about the form and function of the future office environment, significant new office development is not expected before the Survey’s horizon of 2026.

“The common office space trend is a flight to quality. Tenants are moving to areas where there are more amenities. An important part of helping to refill office space in low-occupancy buildings will be offering those amenities that we are seeing where tenants are in fact going into the office, such as high-quality dining, fitness centers, and other ‘lifestyle’ options.”

— Erin Murphy, Partner, Allen Matkins

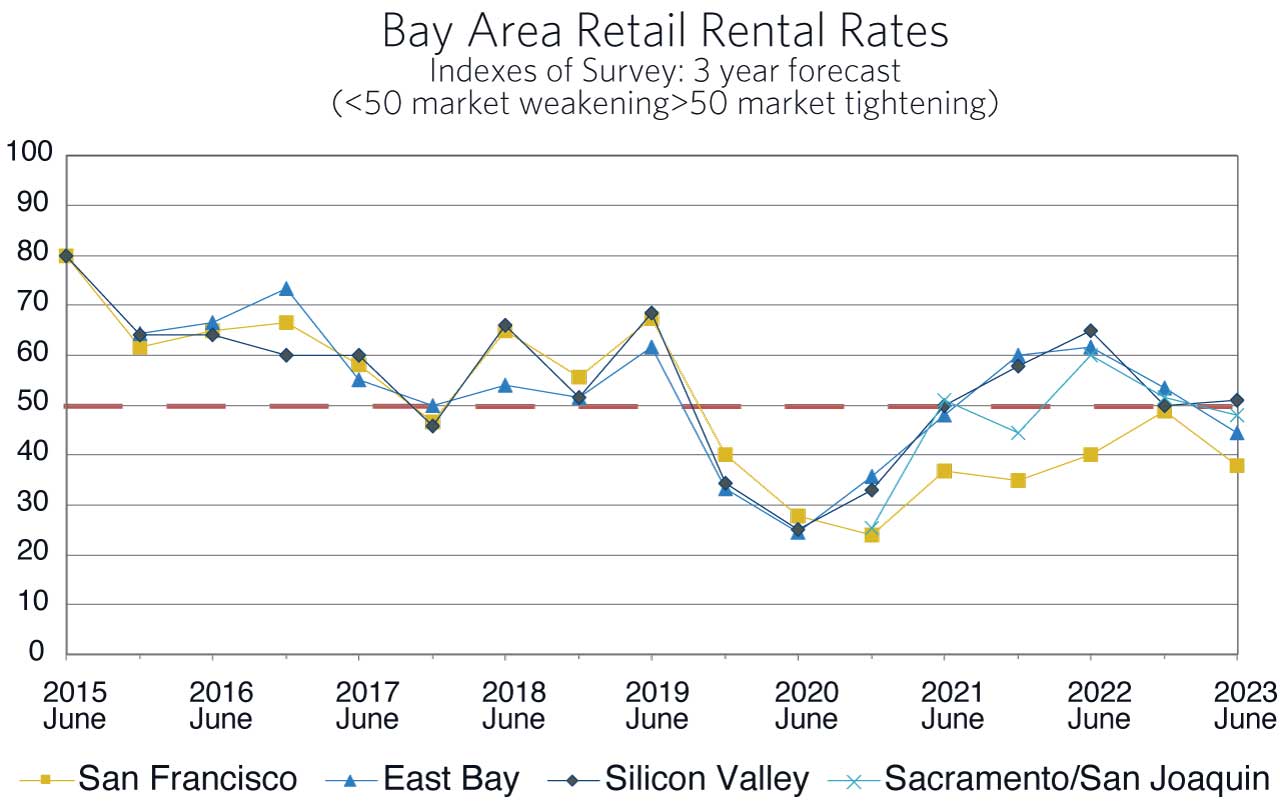

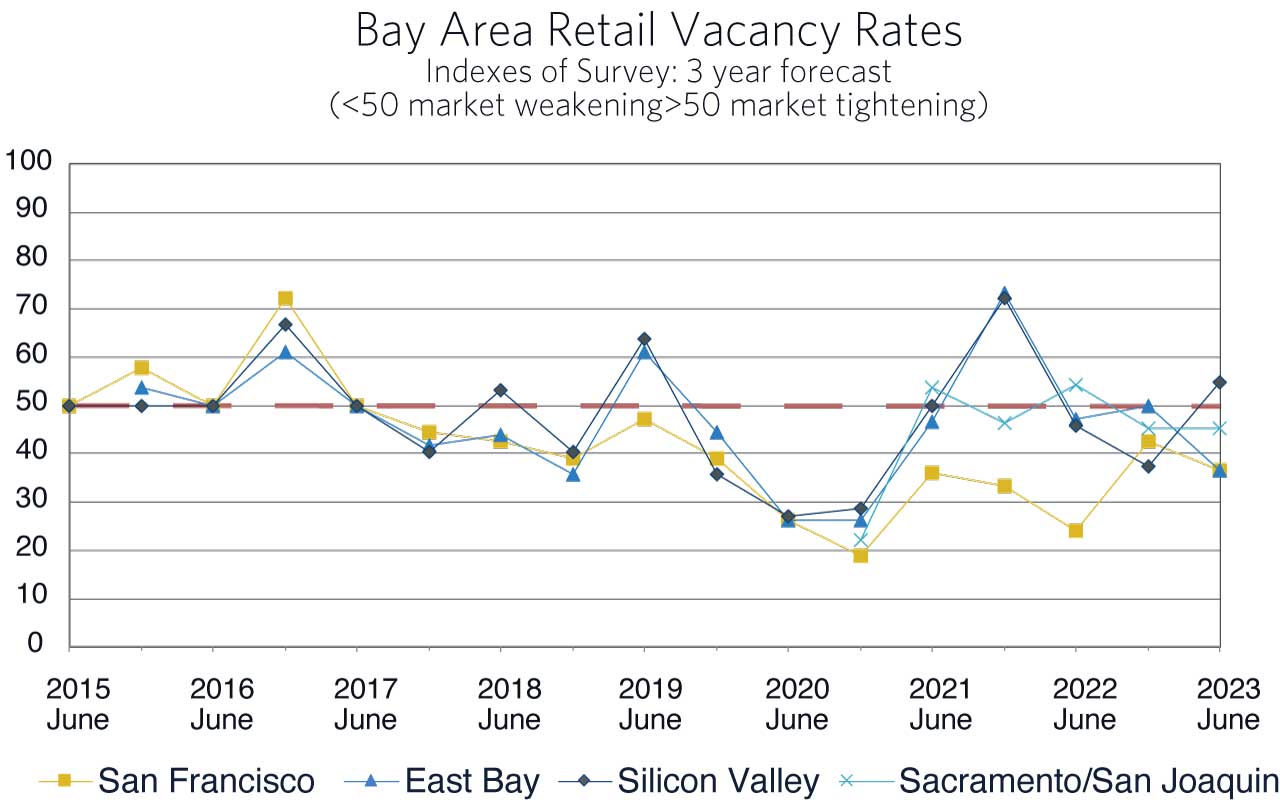

Retail Space Markets

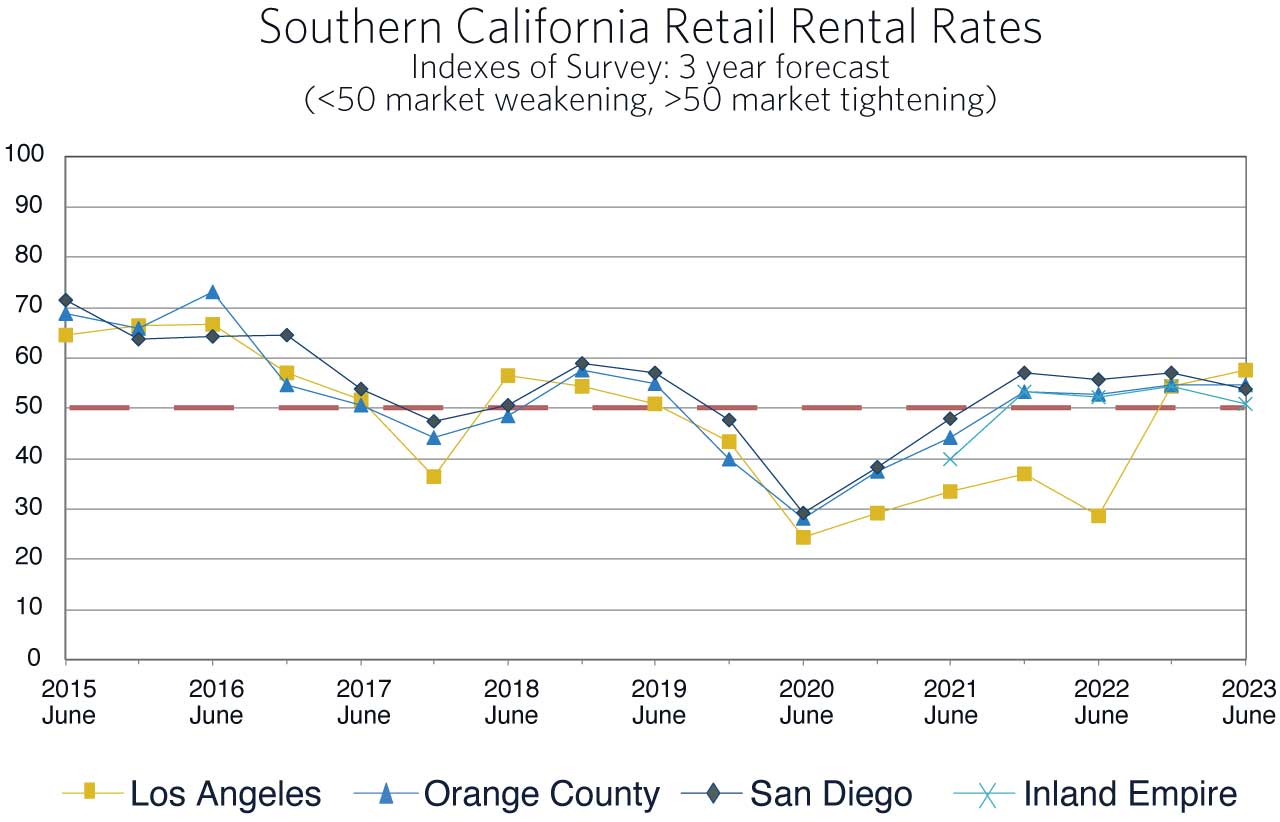

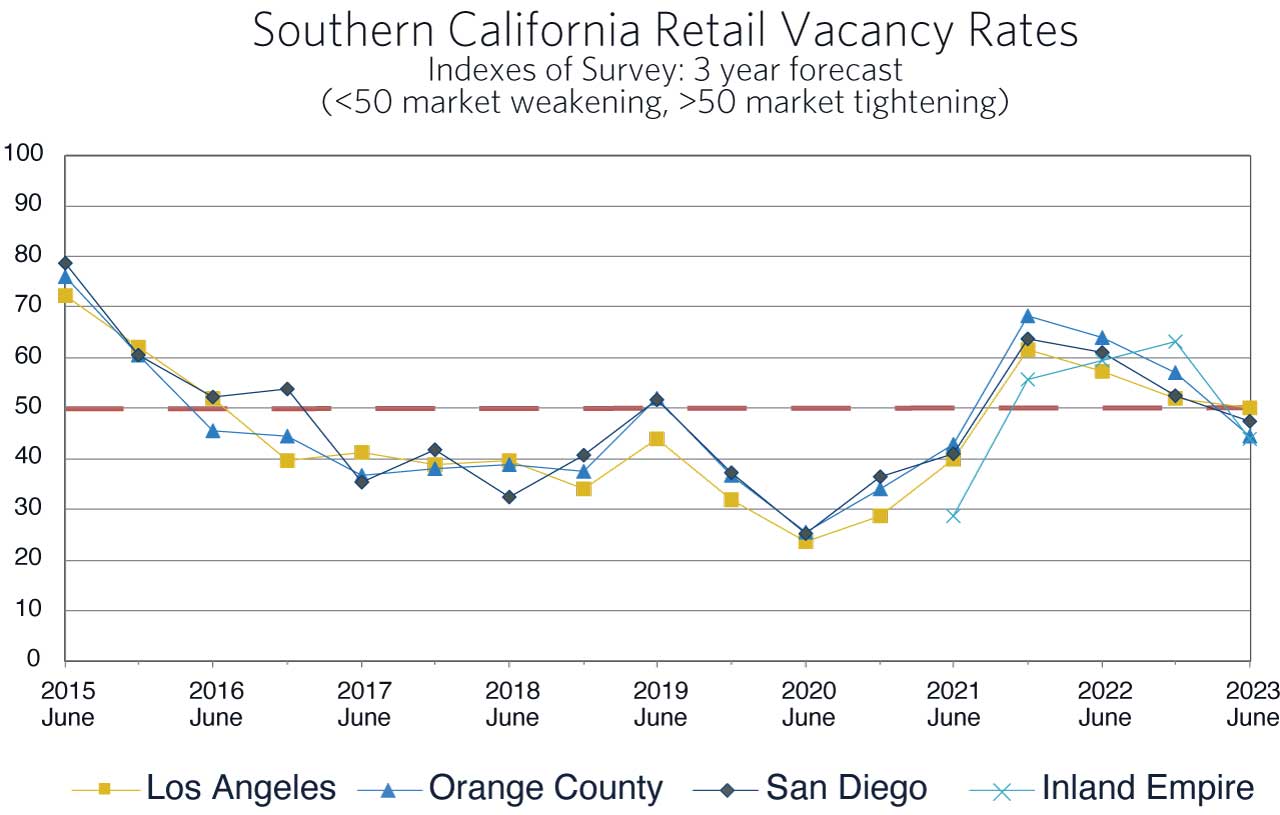

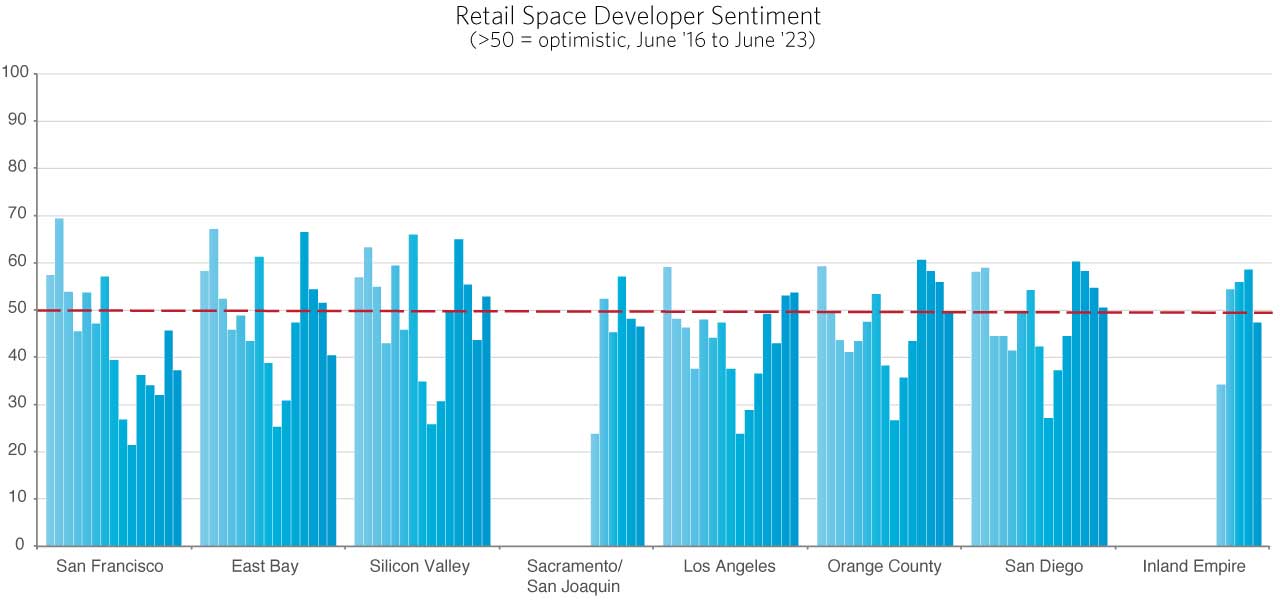

Once again, we ask: “is retail poised to come back from the bottom of the cycle?” The totality of the recent Surveys point to a recovery, although developer/owner sentiment is somewhat mixed, particularly in Southern California. Overall, there are positive signs, and the expectation is for a beginning of a new cycle in retail space by 2026 (Chart 3). Retail sales continue to increase nationwide and the retail trade component of GDP for California, which measures the value added in retail sales activity, posted solid gains through the end of 2022.

The Sacramento/San Joaquin region’s panelists are neutral with respect to the next three years. Certainly, work-from-home and hybrid-work on the part of State Government has had an impact. As Sacramento is the fastest growing large city in the state and commuter cities such as Lathrop and Tracy are posting solid gains in new housing, the expectation was for sentiment to become positive by the current Survey. That expectation has now slid one or two quarters into the future.

There are three forces at work that help create the overall optimism in the Southern California and Silicon Valley retail markets. First, a limited return to the office has increased the demand for retail in portions of these regions. To be sure, it is not back to where it was pre-pandemic, and as indicated above, city centers are still a long way from recovery. Second, the building of new housing has created a demand for new retail close to that housing. Third, there is an expectation of increased demand for the reconfiguration of retail establishments to an open-air post-COVID concept to attract consumers back to stores. The panelists expect some increase in vacancy rates, a direct result of the current high level of sub-leases and slow-walking leases, but they also expect real rental rates to increase.

There are now solid targeted retail development opportunities around the state, particularly where new housing developments are springing up. Despite a possible recession, planned housing construction will continue to generate new retail development demand over the coming three years.

Although the trends in the sentiment indexes are moving in the direction of a turnaround, the percentage of panelists in California planning new developments over the next twelve months is significantly lower than the percentage that began new projects the previous twelve months. This is particularly true in Northern California where developers remain the most pessimistic. Most developers in the eight regions surveyed are planning on remaining on the sidelines in 2023. Nevertheless, the data indicate a turnaround and a new retail building cycle beginning before the middle of 2026.

“During COVID, most retailers developed a robust direct-to-consumer shopping experience, which rivaled e-commerce and proved beneficial for the retail market. In other words, ‘if you can’t beat them, join them.”

— Leslie Mayer, Executive Managing Director, Cushman & Wakefield

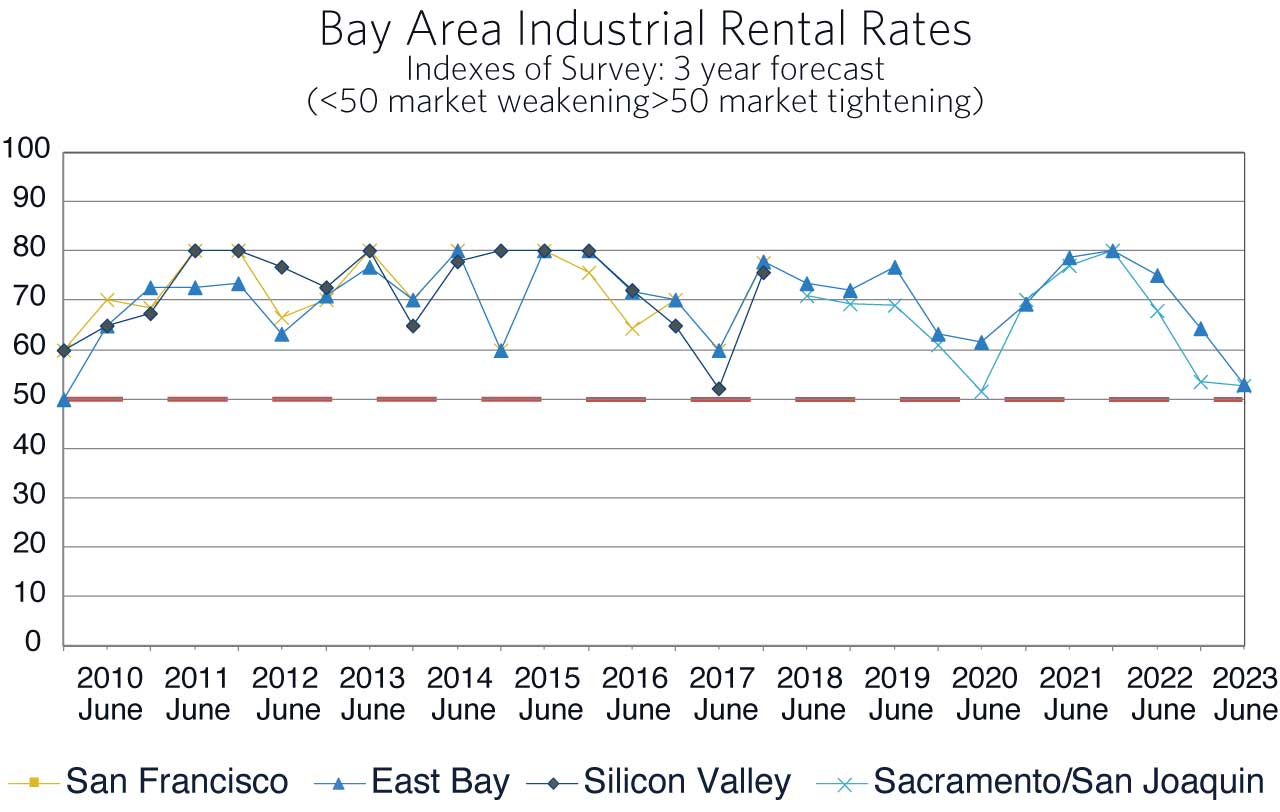

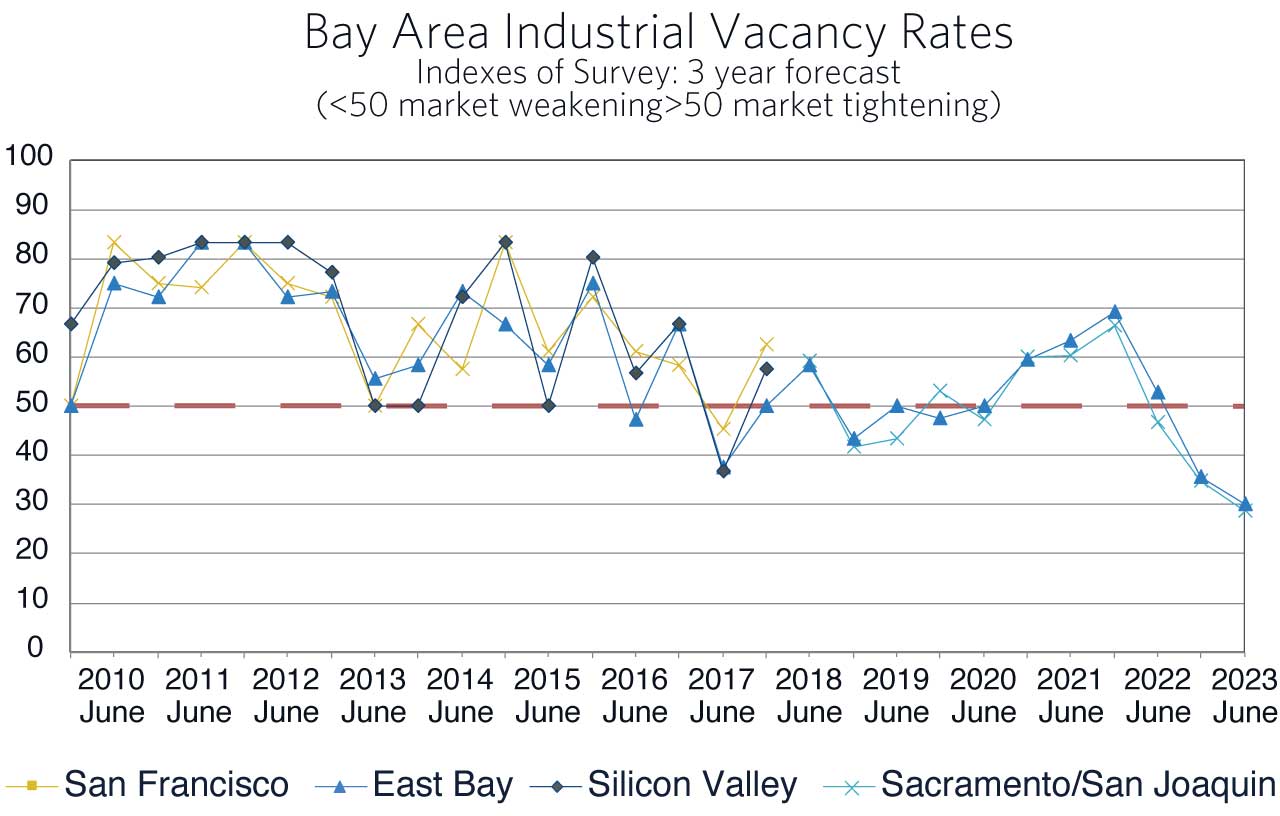

Industrial Space Markets

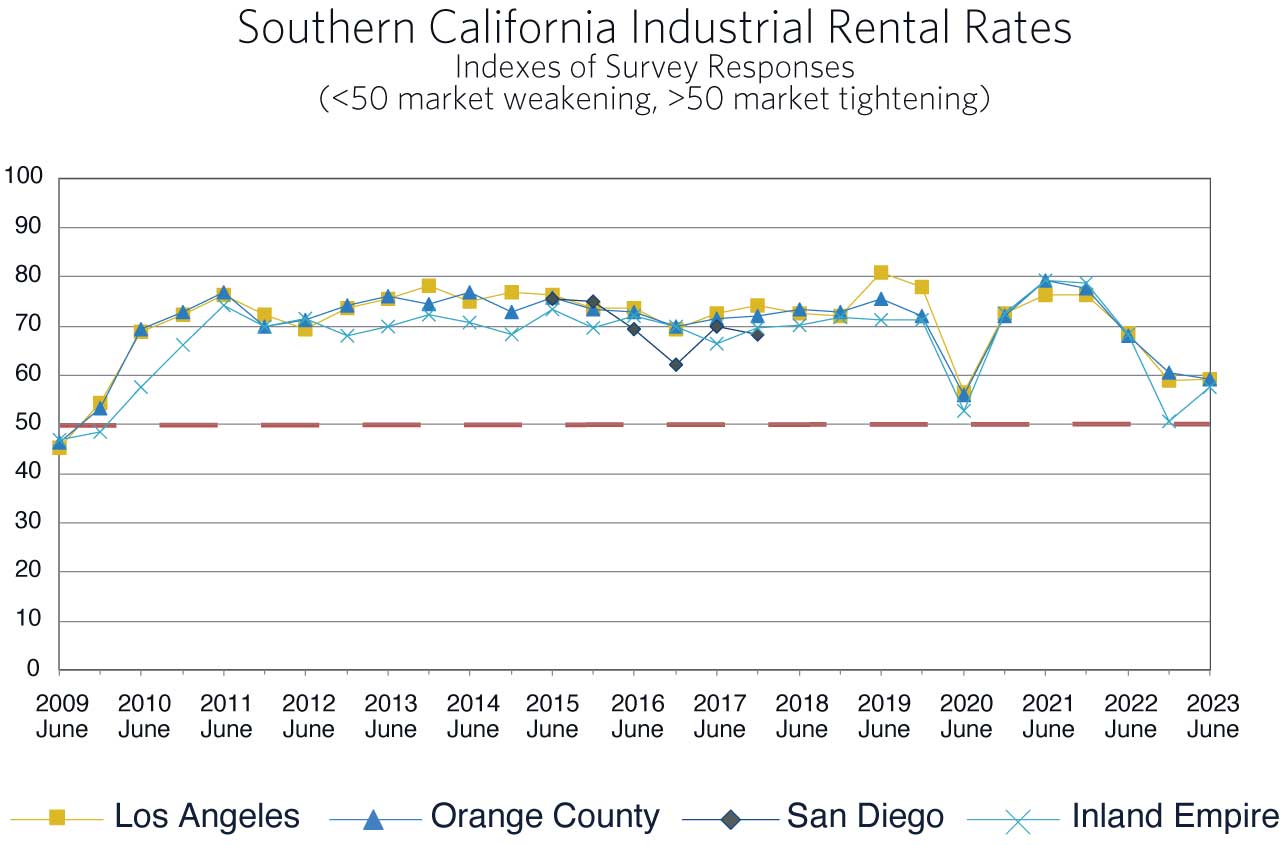

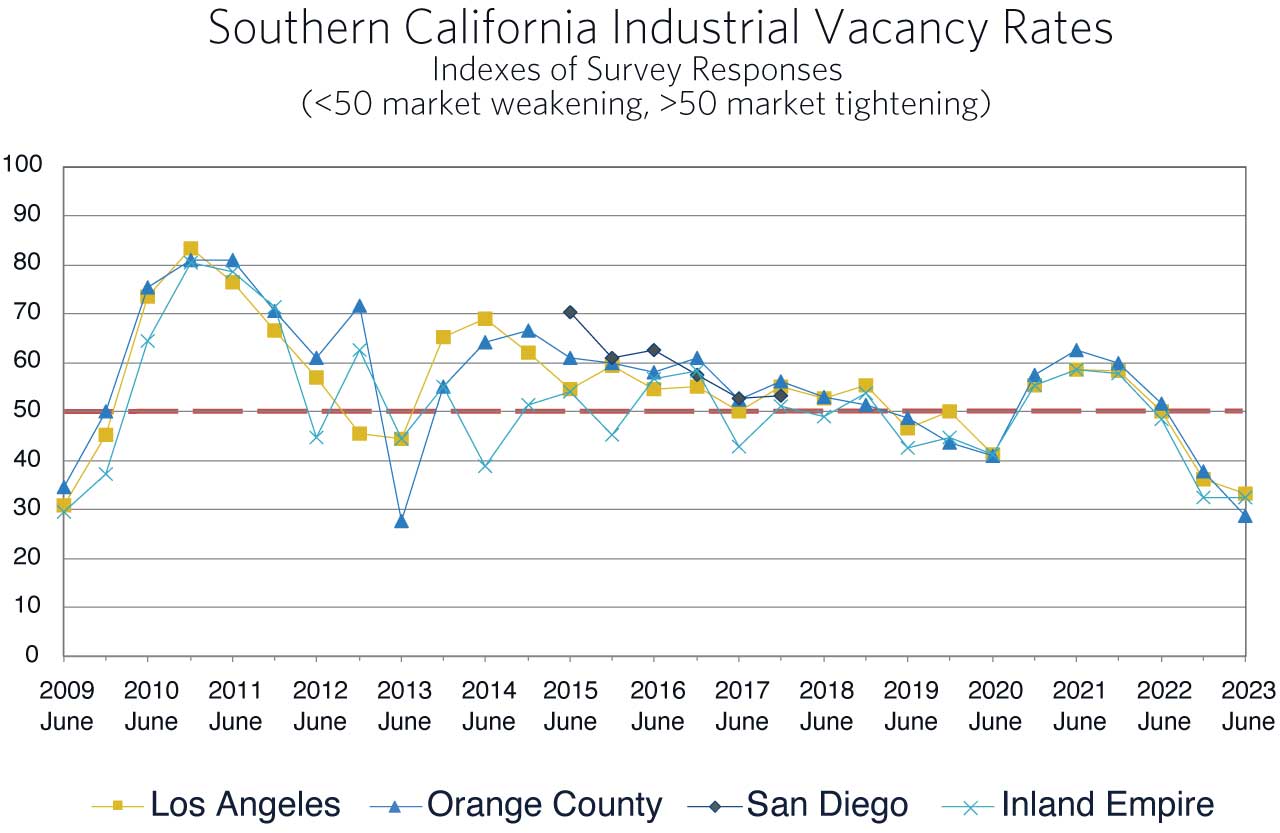

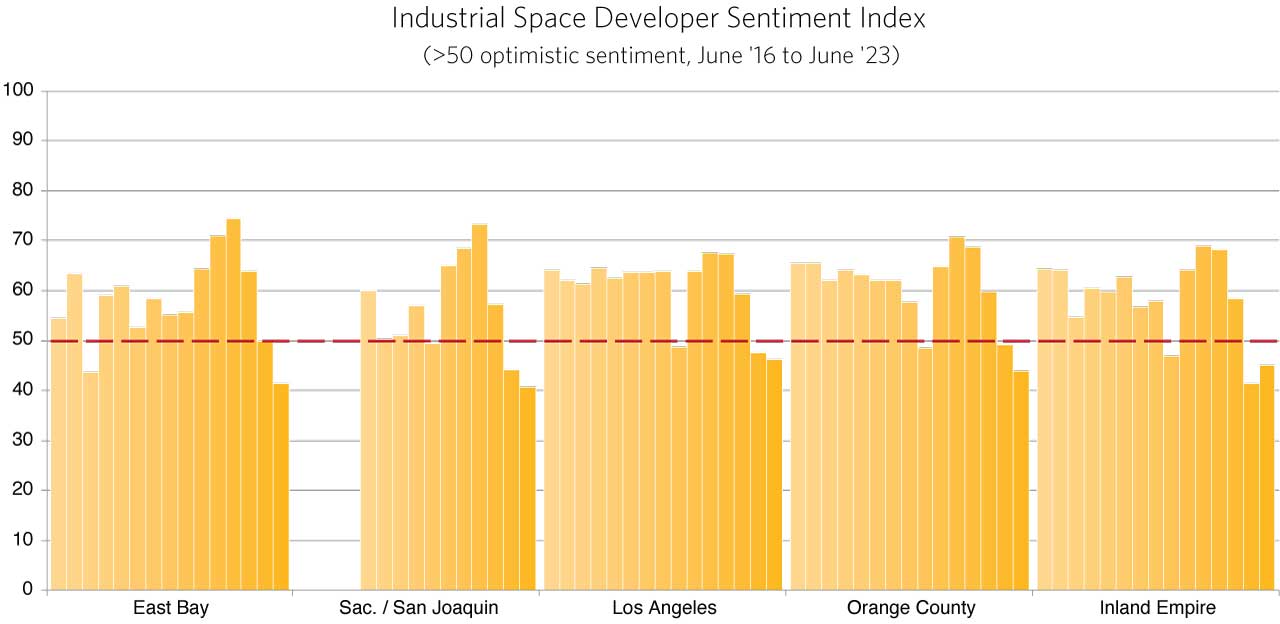

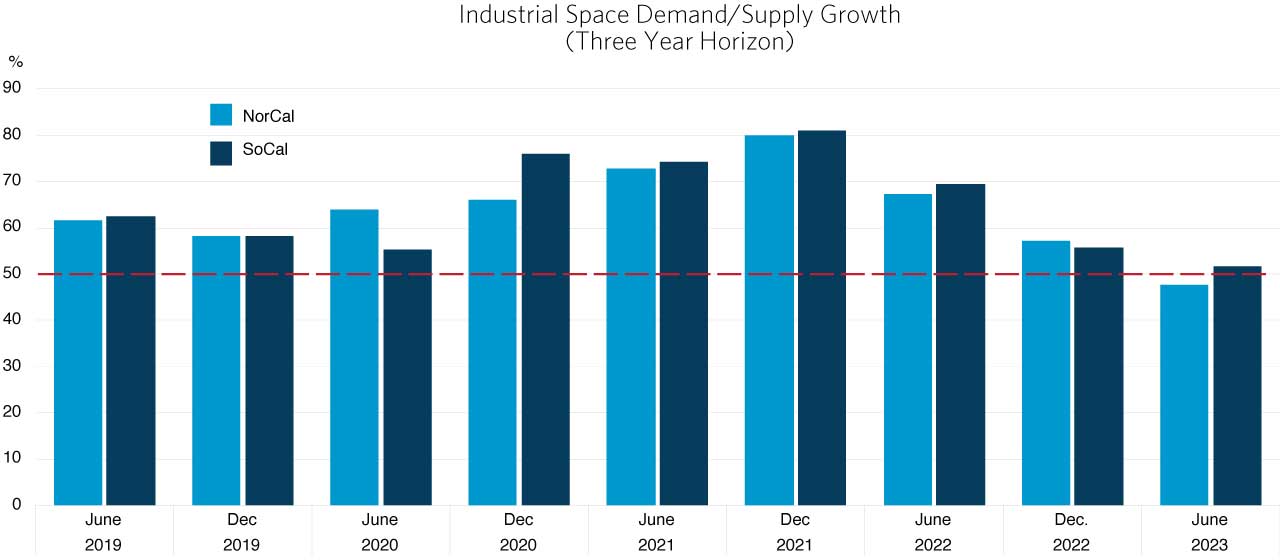

In the commercial real estate realm, industrial space has been the star performer of late. Even though new industrial development continued at a torrid pace through 2022, record high occupancy rates and superior lease rate growth has not abated. The Winter 2023 Survey showed a moderate drop in industrial space developer sentiment for three of the five markets surveyed and now, in the latest Survey, all five markets are showing decidedly negative sentiment (Chart 4). Normally this shift in sentiment would indicate a turning point in the market, and in a sense it does. Industrial markets throughout the state have been overheated for some time and the turn indicated here represents a slight cooling of development.

In Southern California, more than a few million square-foot warehouses are currently under construction as developers have responded to demand levels that have pushed vacancy rates below 1% in both Los Angeles and the Inland Empire. Only now are those vacancy rates inching up to the 2% range. At some point supply should catch up and when it does, vacancy rates will increase a bit further. It is this increase in vacancy rates that led the panelists to indicate in the previous and current Surveys that 2026 will not be as profitable as 2023. In July 2023, after the Summer Survey was complete, a contract agreement between the International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association was signed; an agreement that will increase the demand for warehouse space next year even as economic growth softens.

The percentage of panelists in the Southern California markets planning on beginning one or multiple new developments in the coming twelve months is shown in Chart 5. With the exception of 2021, a greater percentage are planning multiple new industrial development projects than at any time in the last eight years. In addition, except for 2017, a greater percentage are planning a single new development project than anytime in the last eight years. Taken together, these represent the highest level of planned development reported in the Summer Surveys since the Great Recession of 2008/2009. In the two Northern California markets surveyed, the East Bay and the Sacramento/San Joaquin Area, vacancy rates are in the neighborhood of 4%. Consequently, 91% of the panelists are planning new industrial development in this region as well. Clearly, industrial space development continues apace.

“Lower leasing volume has not stopped industrial development. Developers who have their projects already under construction haven’t pulled the plug. Instead, there’s tens of millions of square feet of space that’s currently under construction.”

— Jonathan Consani, Partner, Allen Matkins

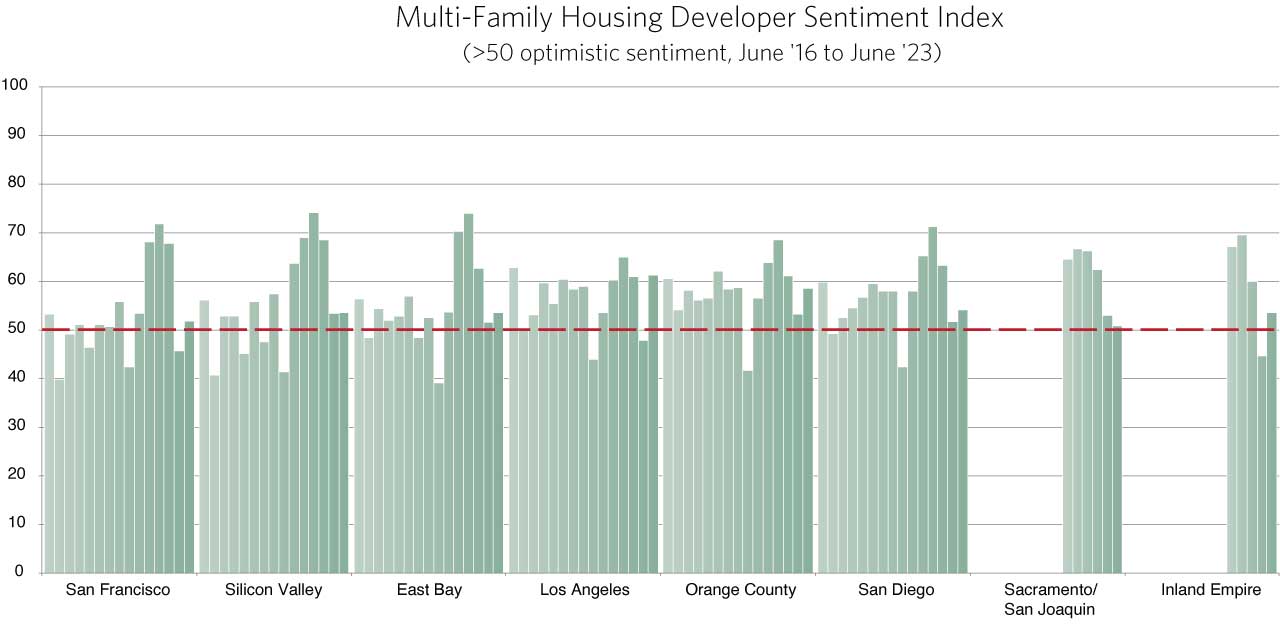

Multi-Family Housing Markets

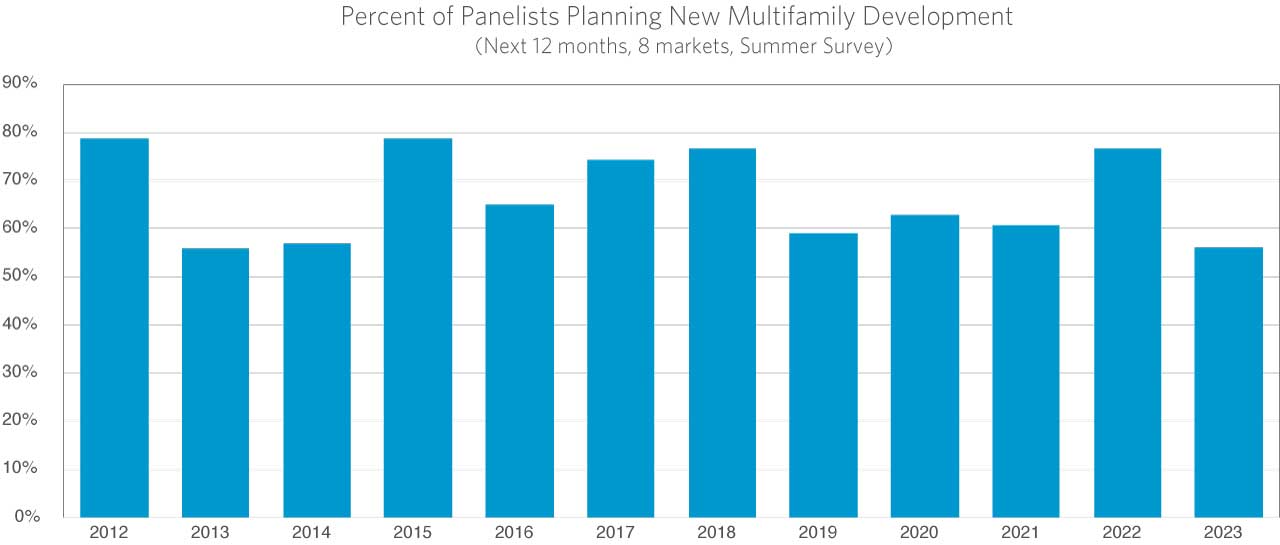

Even though rents have softened, the multifamily panels in each of the eight markets surveyed, including San Francisco, remain bullish about the coming three years. The extent of their optimism is market dependent (Chart 6). In Los Angeles, the Inland Empire, and Orange County the panelists expect vacancy rates to be at least as low as they are today and rental rates to increase more rapidly than inflation over the next three years. Rental rate improvement is also expected in San Diego, with a slight deterioration of occupancy rates. In each of the Northern California markets, vacancy rates are expected to rise. The Bay Area has one of the highest percentages of jobs that can be partially or completely worked remotely, and this clearly impacts demand.

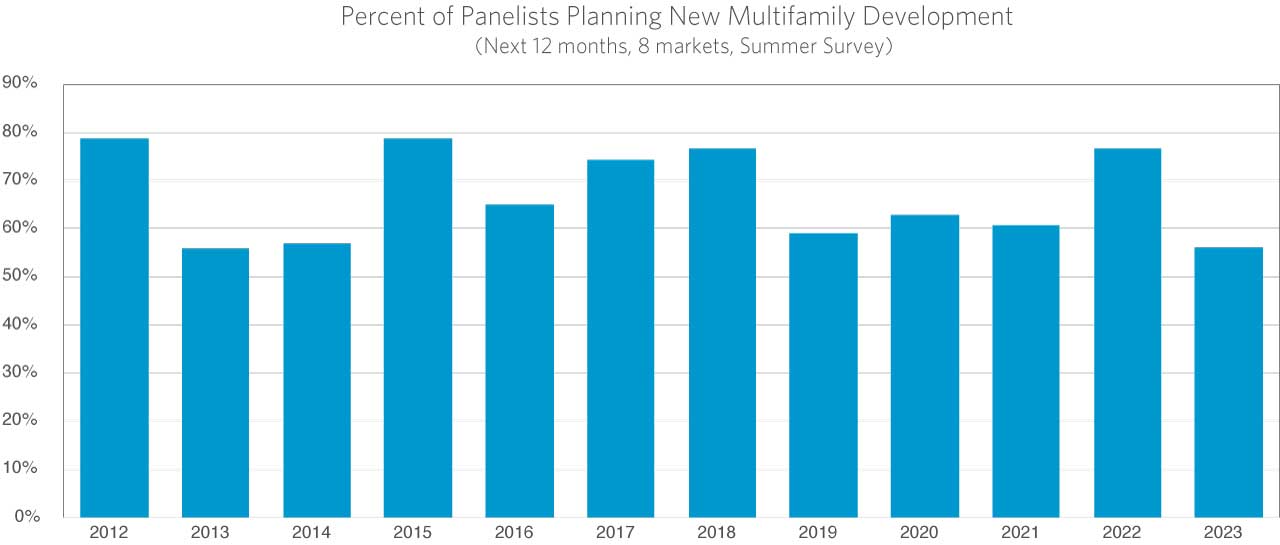

There has been some pull back in development in California this past year as has been the case across the nation. However, the reduction in new development has been less acute in the Golden State. In the current Survey, 55% of the panelists will begin one or more new projects in the coming year with a slightly greater percentage in Southern California than in Northern California (Chart 7).

There are two additional factors driving new multifamily development in the 2023-2026 period. First, the inland parts of the state have been experiencing growth in logistics and infrastructure construction. Second, a series of state laws -- SB8, SB9, and SB10, and AB2011, AB2097, and AB2234 -- superseded some local building approval processes, opened land currently zoned for single-family homes to the construction of small multi-family structures, and have reduced barriers to multi-family construction in transit corridors. Early data indicate that these will be significant factors for the coming year as the latest permit numbers show that over the twelve month period ending April 2023 multi-family building permits in the state increased by 1.8%.

“A general rule of thumb, the more affordable housing you include in your multifamily project, the more benefits you may be able to avail yourself of under state and local law, It’s been interesting to see developers try and figure out how to reconcile those options.”

— Emily Murray, Partner, Allen Matkins

Survey in Perspective

The Summer 2023 Allen Matkins/UCLA Anderson Forecast California Commercial Real Estate Survey was taken as the constellation of economic uncertainties of the past year remain. Our Survey respondents were understandably more cautious about the coming twelve months with increased financing costs and the possibility of a late 2023 recession still in the offing. Nevertheless, industrial markets, which continue to experience historically low vacancy rates, remain poised for a good run of new building and superior returns. Multi-family housing has bounced back rapidly from a “falling-rent” hiatus and significant new development is expected from 2024 through 2026. The current and perhaps surprising turn in sentiment for retail has not yet resulted in significant new building, but the last two Surveys now point to that occurring in the near future. Office markets have a long road ahead as both vacancies and financial overhang require adjusted asset values before a significant increase in new office development will take place. If the recent retail space history is a guide, this process will require time beyond the 2026 horizon of the Survey.

“While the direction of office usage remains uncertain, this Survey indicates that there is a light at the end of the tunnel for other real property asset classes, creating cautious optimism among industry participants. As interest and cap rates rise, we are helping many clients navigate new development and investment opportunities, and engaging market- and sector-specific partners to capitalize on existing market conditions.”

— John Tipton, Partner, Allen Matkins

“Industrial remains poised for a good run of new building and superior returns; multi-family has bounced back rapidly; the turn in sentiment for retail has not yet resulted in significant new building, but the last two surveys now point to that occurring in the near future; and office markets have a long road ahead.”

— Jerry Nickelsburg, Director, UCLA Anderson Forecast