UCLA Anderson Forecast

Economic Update: Vaccine exuberance overshadows surging COVID cases, a slowing economic recovery, and the expiration of emergency social assistance benefits

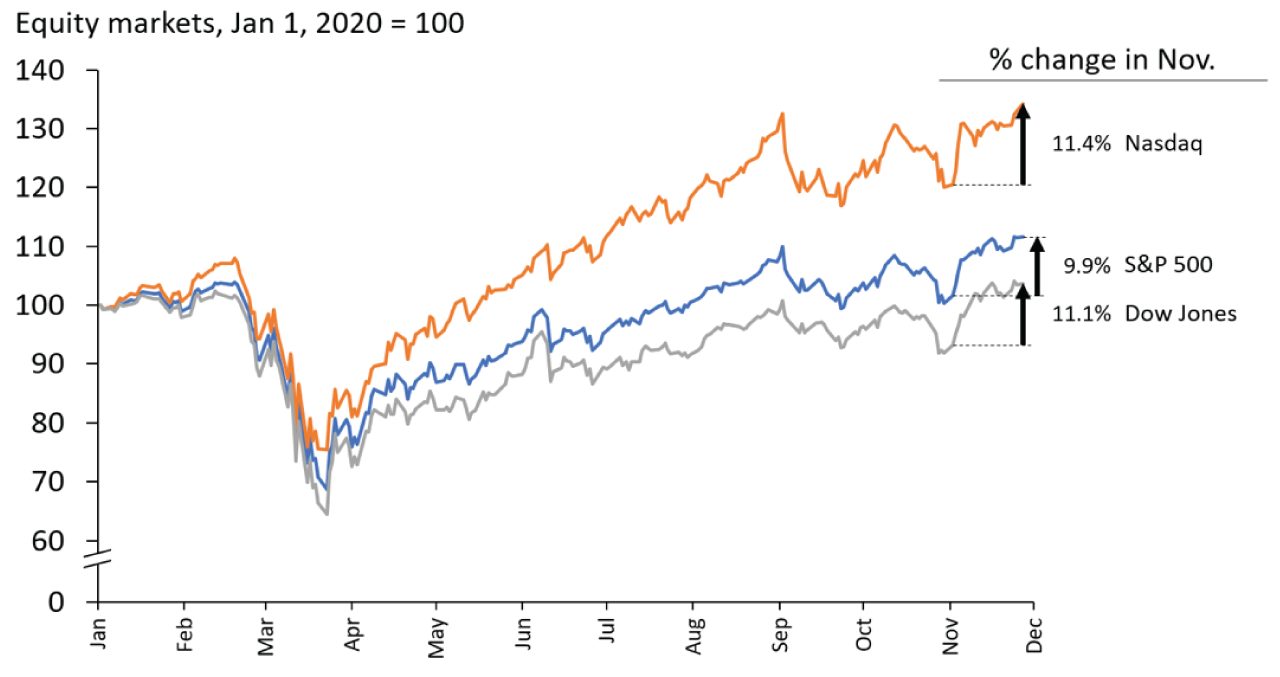

Exhibit 1. Equity markets soar on political stability, divided government, and vaccine news

Source: Yahoo Finance.

Note: Indexed to 100 on Jan 1, 2020. Data through Nov 27, 2020.

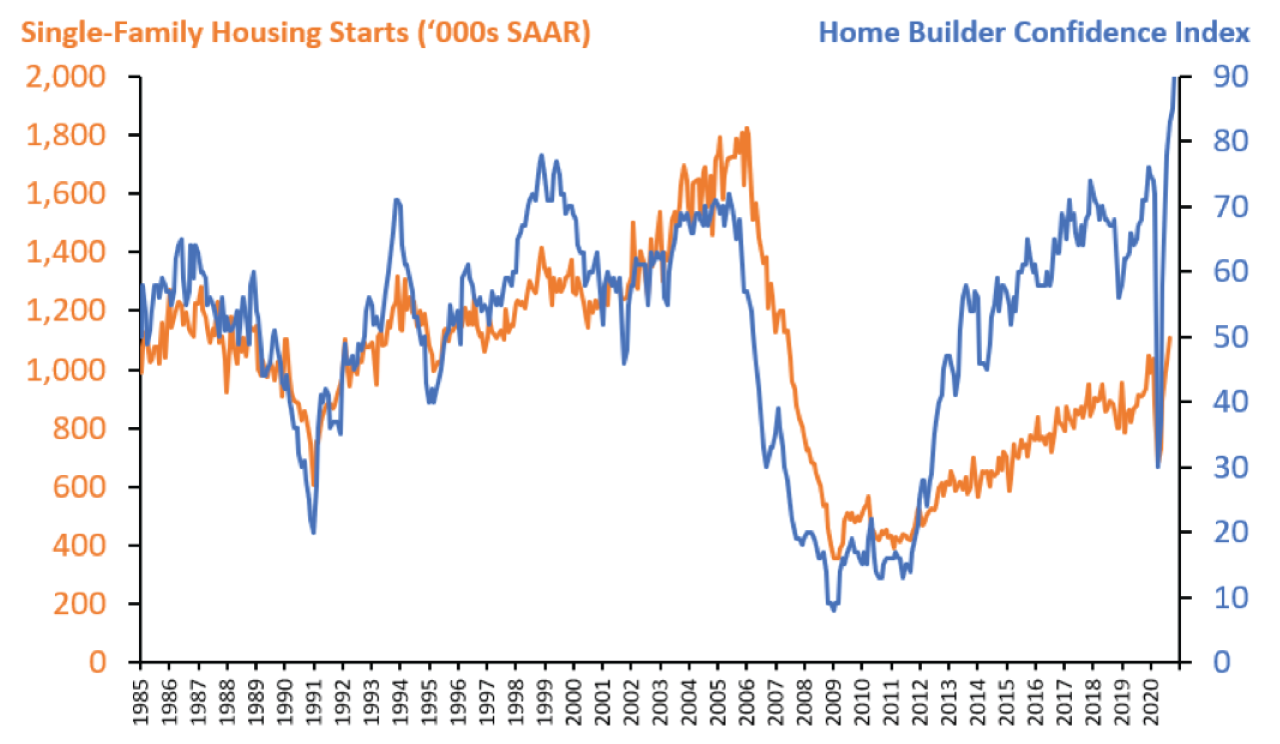

Exhibit 2. The housing market shows continued strength, propelled by record-low interest rates and working-from-home: NAHB/Wells Fargo Housing Market Index reaches new highs and single-family starts at highest level since 2007

Source: National Association of Home Builders, https://www.nahb.org/news-and-economics/housing-economics/indices/Housing-Market-Index.

Note: The NAHB/Wells Fargo Housing Market Index measures home builder confidence. Data are available through November 2020. Single-family housing starts data are available through October 2020.

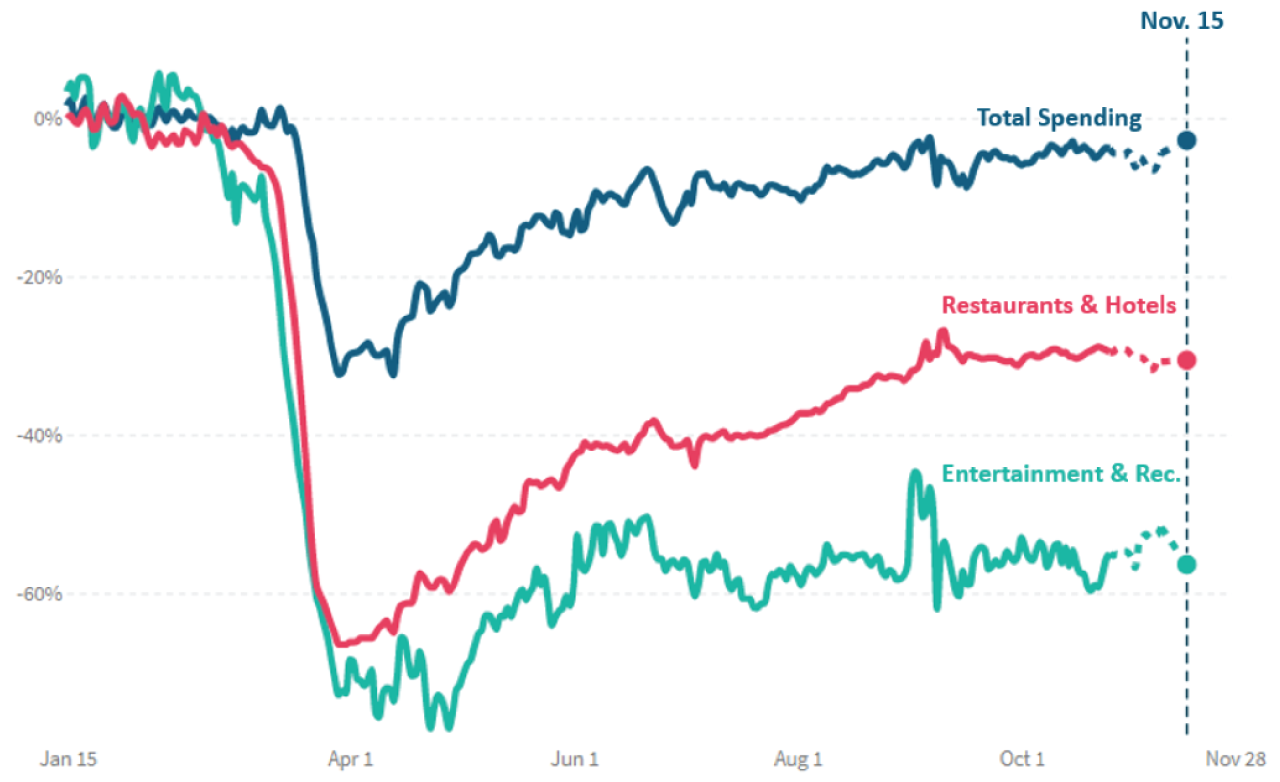

Exhibit 3. High frequency data show consumer spending on services slowing further in recent weeks

Source: Opportunity Insights, Economic Tracker, https://tracktherecovery.org/.

Notes: Change in average consumer credit and debit card spending, indexed to January 4-31, 2020 and seasonally adjusted. The dashed segment of the line is provisional data, which may be subject to non-negligible revisions as newer data are posted. Series from Opportunity Insights based on data from Affinity Solutions. Last updated November 24, 2020.

For this edition of Forecast Direct, we discuss economic policy and the recovery with Dr. Gbenga Ajilore, Senior Economist at the Center for American Progress. Dr. Ajilore is an expert on regional economic development, macroeconomic policy, and issues of diversity and inclusion. His articles are available here. Following is a summary of the conversation. Full audio and video are available here.

Leo Feler (LF): This pandemic and recession have disproportionately affected women and people of color. We’ve seen higher COVID infection rates and higher mortality rates for people of color. We’ve seen unemployment increase more and then come down more slowly for women and people of color. Why are we seeing these disproportionate impacts?

Gbenga Ajilore (GA): There are several reasons why we see higher COVID infection rates and mortality rates for people of color. It comes down to historical structural discrimination that has segregated communities of color into certain neighborhoods. These neighborhoods have less access to healthcare, through less insurance and less availability of healthcare facilities. Once the virus hit, this made it harder for communities of color to be able to tackle it.

LF: How about exposure to the virus, in terms of where people in these communities work? Not only is it the case that, once exposed, there is less access to healthcare, but also that people in these communities are more likely to be exposed in the first place.

GA: This is the concept of “essential workers,” who tend to be disproportionately people of color. These are workers in essential jobs. But we don’t see as much of the hazard pay and PPE (personal protective equipment) for them. These are workers in pharmacies and grocery stores, gig workers who drive and deliver products, and who are going to be more exposed to the virus. When you look at data on who’s more likely to work from home, it’s people with higher incomes, not people in communities of color.

LF: In terms of economic impacts, how is this recession different?

GA: This downturn has hit women much harder than men. In most previous recessions, men tend to be hit harder and earlier, but this time, it’s all about women. A lot of this has to do with industry mix. If you look at leisure and hospitality, it’s disproportionately Latina. In April and May, they had an unemployment rate of about 20%. If you look at what’s happening with state and local governments, there’s been a lot of employment loss, which tends to be disproportionately Black women. And in September, we saw that nearly 1 million women dropped out of the labor force, which has to do with the lack of caregiving infrastructure.

LF: What can we do in our current situation to make the recovery more equal.

GA: The simplest thing is to have more fiscal relief. In March and April, there was a lot of momentum from Congress to pass bills: the Families First Act, the CARES Act, PPP (Payment Protection Program). And it worked. All the research done over the past few months shows that this helped keep the economy afloat. But since April, we haven’t done anything further, and the virus is actually worse now than in April.

LF: What form would this fiscal relief take? Would you advocate for more PPP, for an extension of unemployment benefits, for direct stimulus payments? Should we do anything differently than we did back in April?

GA: All of the above. We’re looking at more than 250,000 deaths and more than 10 million cases. The things we did before all helped: the direct checks, the expanded UI (unemployment insurance) benefits, paid sick and family leave, these all helped people weather the storm that’s continuing. There were some issues with UI and PPP, but these can be fixed. Black and Hispanic-owned firms didn’t have as much access to PPP, but we can fix that and be more targeted. Parts of the country are going on lockdown again. That’s going to harm businesses, but we can pay businesses to be able to weather the storm. We want to tackle the virus, but we don’t want to harm households, small businesses, and state and local governments. The federal government can provide funding to help them weather the storm through the winter.

LF: In April and May, PPP support didn’t go to businesses owned by people of color as easily as it did for other populations. Why is that, and what can we do better this time around?

GA: The biggest problem was access to capital. Some of these communities are under-banked. We need to push banks to lend to other communities. If you had an existing relationship with a bank, then you had easier access to PPP, but a lot of these businesses didn’t have existing relationships. We also need to empower other institutions like CDFIs (Community Development Financial Institutions) and credit unions that target communities of color and have more capacity to reach these groups. We need to think about who has access to capital and how we can open up more avenues to access capital.

LF: There’s been a lot of research on how discrimination hurts the overall economy. How does it harm the overall economy and make us all worse off?

GA: In economics, we think about people’s productive capacity and how that adds to the broader economy. What discrimination does is limit people’s productive capacity. There was a recent study done by Citi estimating the cost of discrimination to the economy. Since 2000, they estimate that discrimination cost the economy $16 trillion. It’s through a number of different avenues. One is the racial wage gap – African Americans, Hispanics, and even Asians, there’s a wage gap for these groups. If we close this wage gap, these individuals earn more money, which means they spend more money, which goes into the economy and has a multiplier effect. Second is the home ownership gap. We have housing segregation, and it’s not just historical. There are examples now, from mortgage applications, where African Americans pay higher interest rates for the same exact house, and therefore, it costs them more and they have less money to spend. If we close this gap and give people access to housing in places where housing values rise, then that will drive more wealth, which adds to the economy. Third is education. There are differences in access to education. If you improve access to education and people are able to get better jobs and higher wages, that also has an impact. If you close all these gaps, that means there’s more productive capacity and income, and that helps the broader economy to the tune of $16 trillion.

LF: This past year has been marked by police violence and disproportionate economic effects on communities of color. With a Biden administration, what can we do during these next four years to really make a difference?

GA: We have laws to counteract discrimination. What we don’t have is the staff, budget, and resources to act upon them. There’s been a reduction in budgets as part of the small government movement. We have the Equal Employment Opportunity Commission, we have the Occupational Safety and Health Administration, but there hasn’t been proper enforcement to keep people safe. I also want to focus on the IRS. Their budget over the last ten years has been slashed. Their enforcement comes down to going after “EITC frauds.” The reason why is because it’s easy and cost effective. All they have to do is send letters to people that say we think you’re engaging in fraud and you have to pay us back. The problem is that this disproportionately hits communities of color. There was a study by ProPublica showing that the highest enforcement was a county in Mississippi that was 60% Black with median income of around $20,000. The IRS shouldn’t be going after these people. The IRS should be going after corporations and high-income households who are engaging in tax avoidance and tax cheating. In putting more money into the IRS to enforce that, it has a positive return to the federal government and can allow it to better fund its operations. One of the biggest things we could do is fund the agencies that are supposed to go after discrimination – the IRS, EEOC, OSHA – that could actually help close these gaps.

GA: The other thing is criminal justice policy. We want to limit the number of people who enter the criminal justice system. And once they come through the system, we want these returning citizens to have access to programs to help them engage in economic mobility. On the front end, we can limit sentencing, limit what counts as a felony, limit fines and fees, which are very onerous. You have people who receive fines, and then they can’t pay the fine, and they end up going to jail, which puts them on a different trajectory. But going back to revenue, a lot of states and localities rely on fines and fees, because they don’t have revenues from taxes to be able to fund services. So just funding government – federal, state, local – that’s going to have positive impacts on discrimination, on criminal justice, and on a lot of the problems we’ve seen, not only during the last four years, but that have been going on for decades.

LF: I think the good news is that there are so many areas where even minor policy changes can yield large improvements. Gbenga, thank you so much for your time.