Fink Center for Finance & Investments

Latest News and Events

Fink Center for Finance and Girls Who Invest Help Close the Gender Gap

UCLA Anderson faculty and industry professionals educate young investors

Larry Fink (B.A. ’74, ’76) Says Climate Risk Is Investment Risk

Students and Recruiters Gather Virtually for 5th Annual Fink Credit Pitch Competition

Chicago Booth takes first place pitching Univision

Our Purpose

Our History

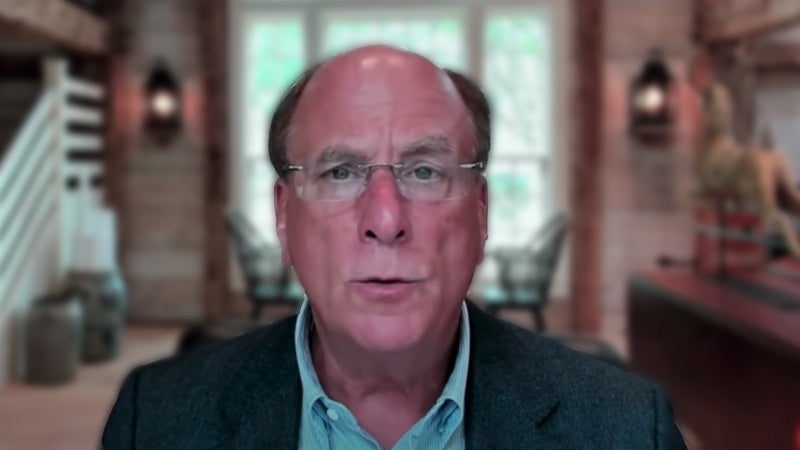

The Center was founded in 2006 under the faculty leadership of Professor Richard Roll, distinguished Professor Emeritus. Its founding members, a group of Anderson alumni at the pinnacle of achievement in the field of finance, enshrined the Center’s mission to connect academia with industry. In 2008, a generous gift from Larry Fink, Chairman of the Board and CEO of BlackRock, and his wife, Lori, endowed the Center, renaming it in their honor. Mr. Fink has continued to lend his support to the Center and has served as Chairman of the Board since its founding.

“I am confident that students utilizing the Fink Center will be prepared for a successful career in finance — ready to make a meaningful impact in the ever-changing financial marketplace."

Laurence D. Fink (B.A. '74, MBA ‘76)

Chairman & CEO, BlackRock

Signature Events

Perspectives in Portfolios

Since 2012, the Fink Investing Conference has brought together some of the most respected individuals in the investment management community to educate and connect a wide range of financial industry participants

Elevated Discussion on Private Equity

The financial industry's brightest minds from top private equity shops in Southern California lead powerful discussions illuminating the path to the future of private equity

A Wall Street Simulation

Ten MBA teams from across the country will pitch their best credit investment ideas to a panel of distinguished judges with the hopes of taking home the top prize in the annual Fink Credit Pitch Competition

World-Class Academics and Extracurriculars

Faculty Research in UCLA Anderson Review

When Younger Investors Overreact to News, Others Feel It

Inexperienced investors, lacking historical context, impact markets

How an Excess of Stock Analyst Optimism Lands on Companies Least Deserving of It

Results of financially weak firms are difficult to forecast; in uncertainty, Mark Grinblatt finds, Wall Street’s views are overly generous

How Tech's Disruption Alters Investors' Appetite for Risk

New technology’s upending of the old creates demand for alternative assets to offset risk

Stay Connected with the Fink Center!

Contact Us

The Laurence and Lori Fink Center for Finance

UCLA Anderson School of Management

110 Westwood Plaza, Room A307, Box 951481

Los Angeles, CA 90095-1481

Email: fink.center@anderson.ucla.edu

Office: (310) 825-3867