Winter 2024 Survey

Post-Pandemic Adjustment and Growth

Adjunct Professor of Economics, UCLA Anderson School

Senior Economist and Director, UCLA Anderson Forecast

In the six months since the last survey, interest rates and cap rates have bumped up, while the oft predicted by some but never seen recession has faded into the past. U.S. non-residential construction was up by an annual rate of 1.2% in October, and residential construction permits have climbed above their historical average. The Winter 2024 Allen Matkins/UCLA Anderson Forecast California Commercial Real Estate Survey reflects both overall optimism and a mixed picture in the composition making up the aggregate numbers. Even though there is more optimism in many sectors, particularly retail, the Winter 2024 Survey panelists across all types of commercial real estate and regions of California indicated they are facing a more challenging financial landscape as required equity percentages and required investment return hurdle rates (IRR) are expected to increase over the coming three years.

Statistical forecast analysis has as its basis the proposition that past statistical relationships hold into the future. A knowledge of those correlations, current data and perhaps some assumptions about data not yet known, lead to the forecast. In addition to the summary measures of developer sentiment reported here, the Survey has a rich set of questions such that, with past trends in the Survey’s indexes, we can now infer a more nuanced turn in commercial real estate markets.

The Allen Matkins/UCLA Anderson Forecast California Commercial Real Estate Survey compiles the views of commercial real estate developers, owners, and investors with respect to markets three years hence. The three-year time horizon was chosen to approximate the average time a new commercial project requires for completion (though projects with significant entitlement and/or environmental issues often take much longer). The panelists’ views on vacancy and rental rates are key ingredients to their own business plans for new projects, and as such, the Survey provides insights into new, not yet on the radar, building projects and is a leading indicator of future commercial construction. For example, if a developer were optimistic about economic conditions in Silicon Valley’s office market in 2026, then initial work for a new project with an expected ready-for-occupancy date of 2026 — a business plan, preliminary architecture, and a search for financial backing — would have to begin no later than the latter part of 2023. Although optimism does not always translate into new construction projects, this sentiment is usually a prerequisite for it.

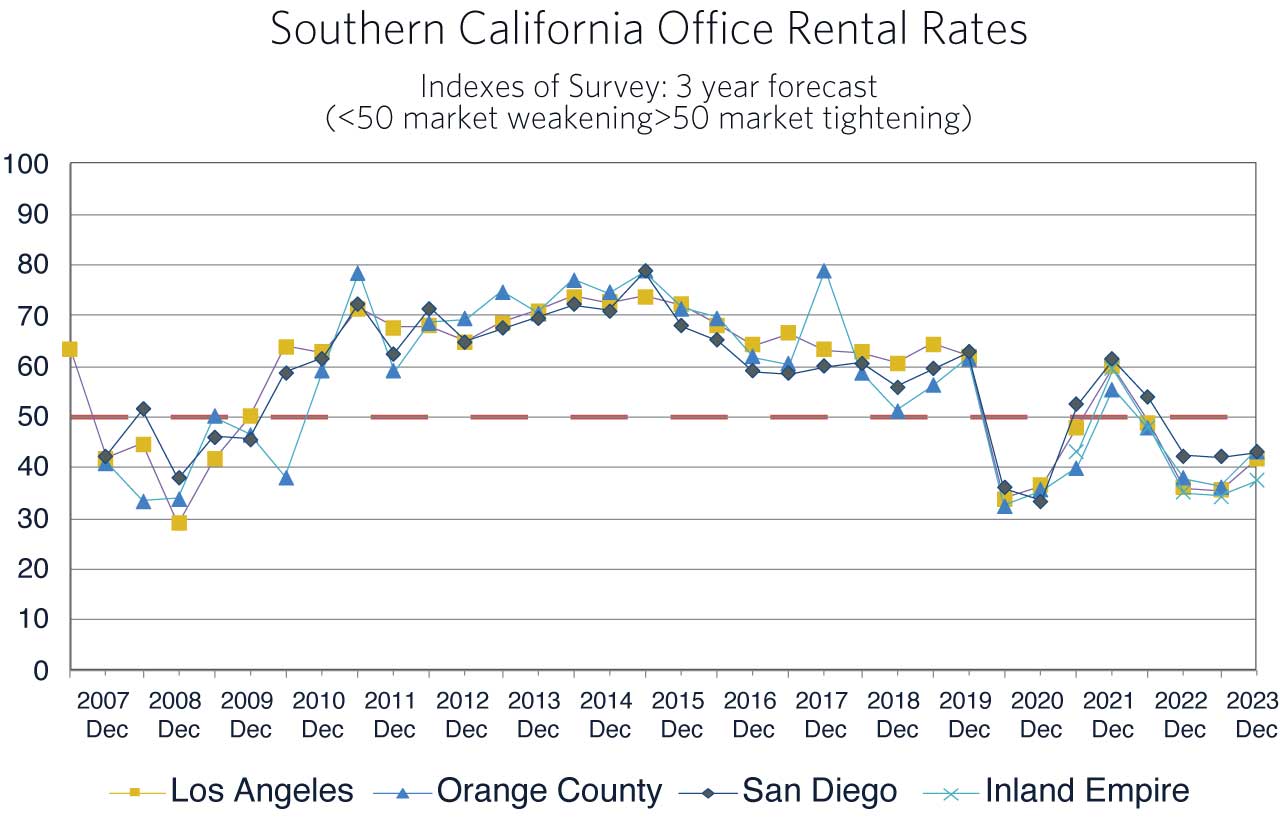

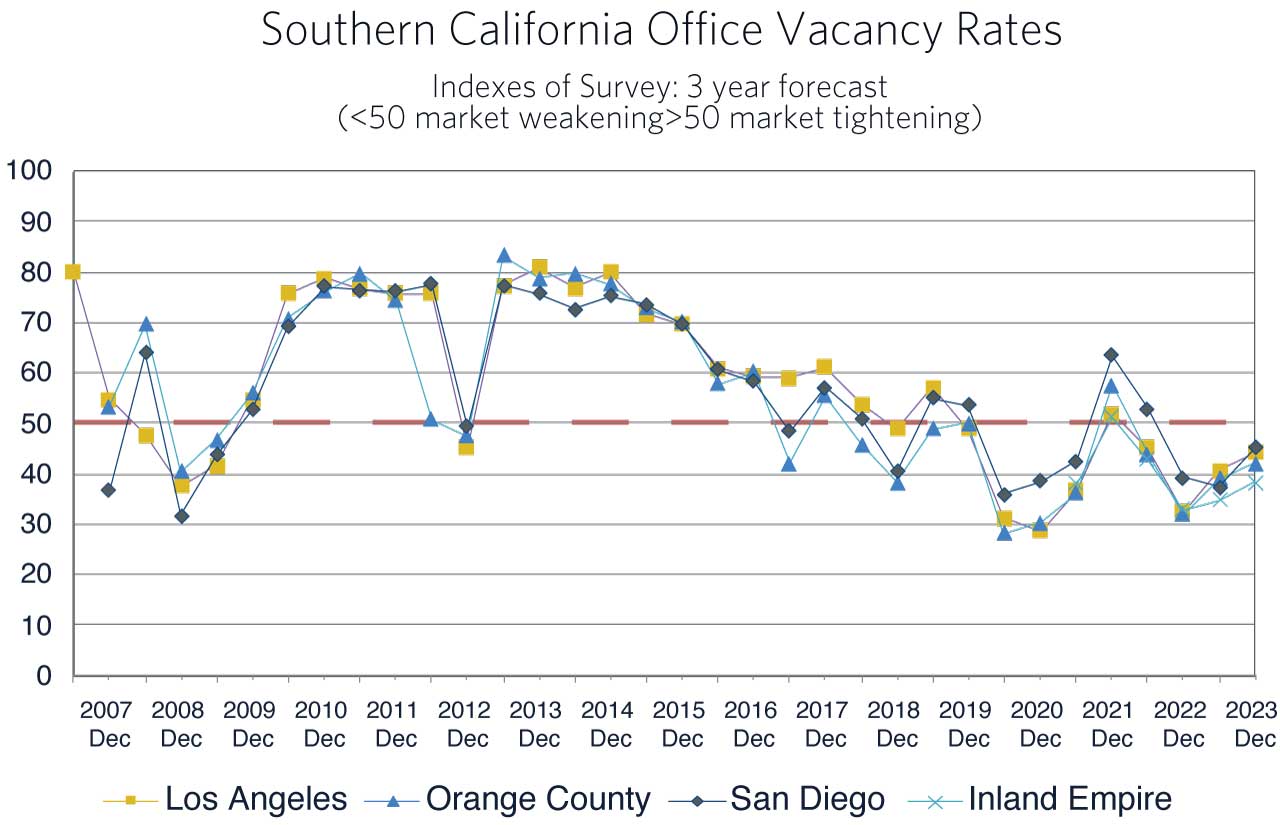

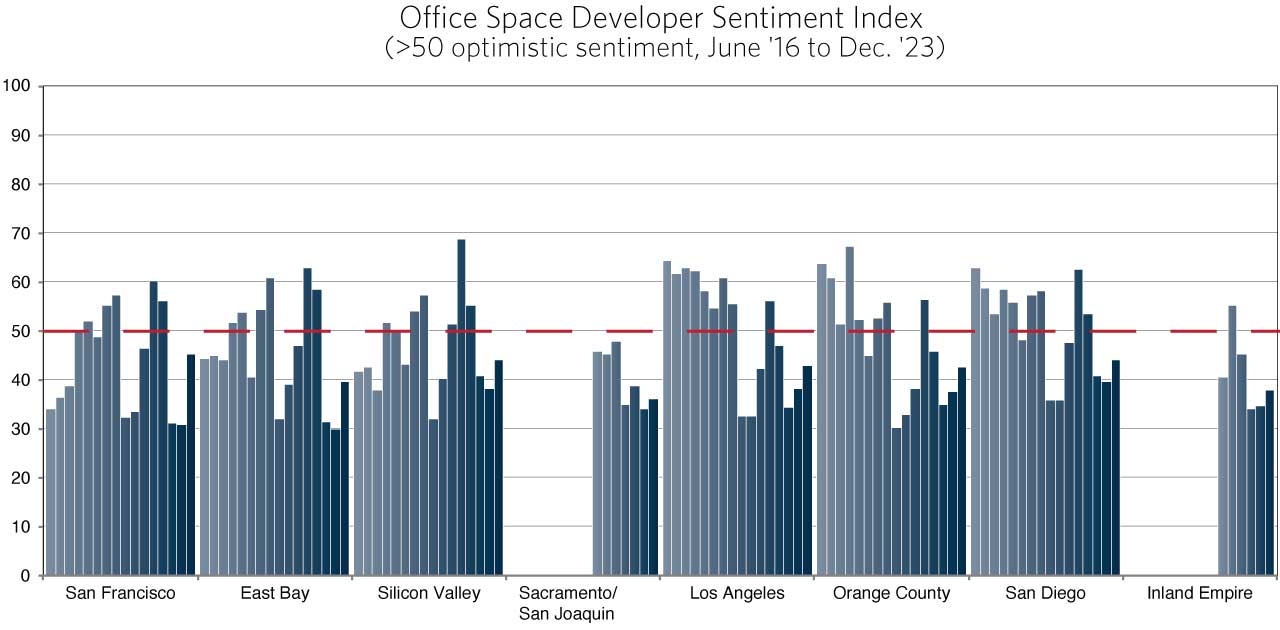

Office Space Markets

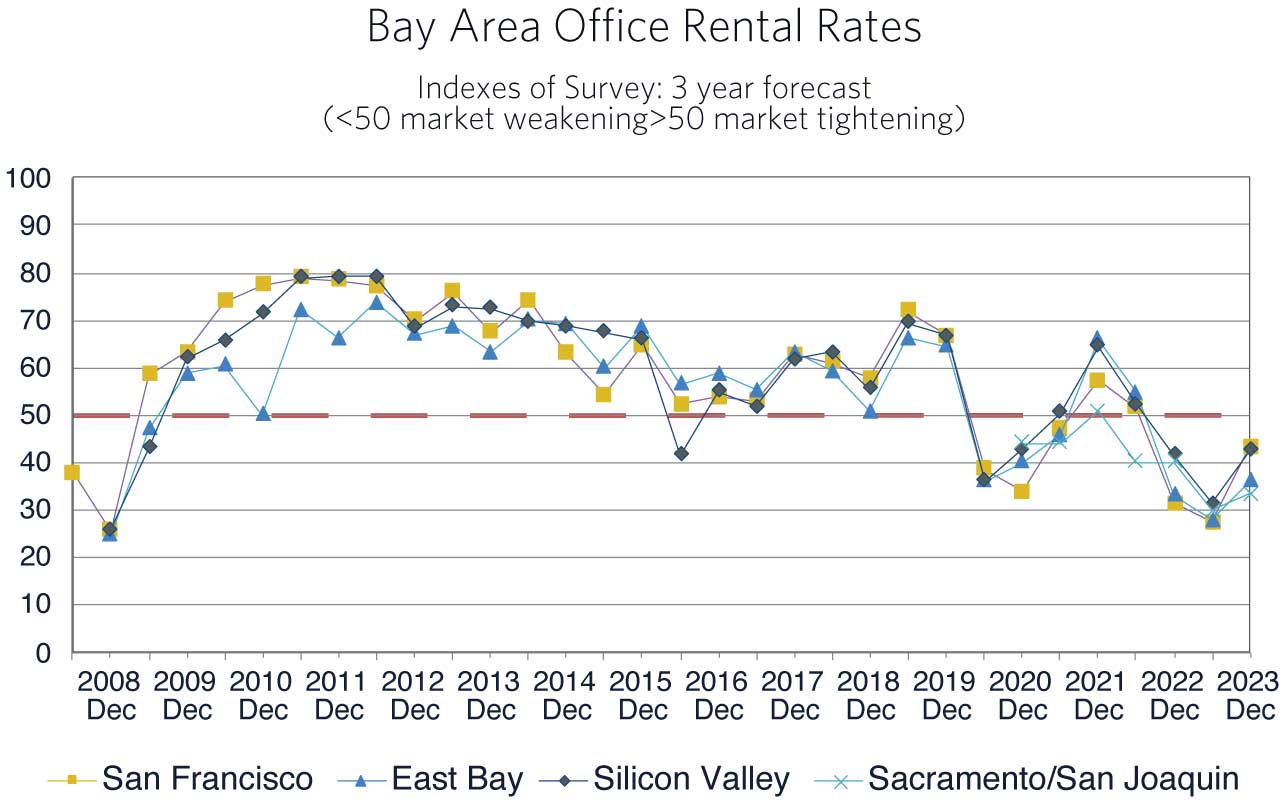

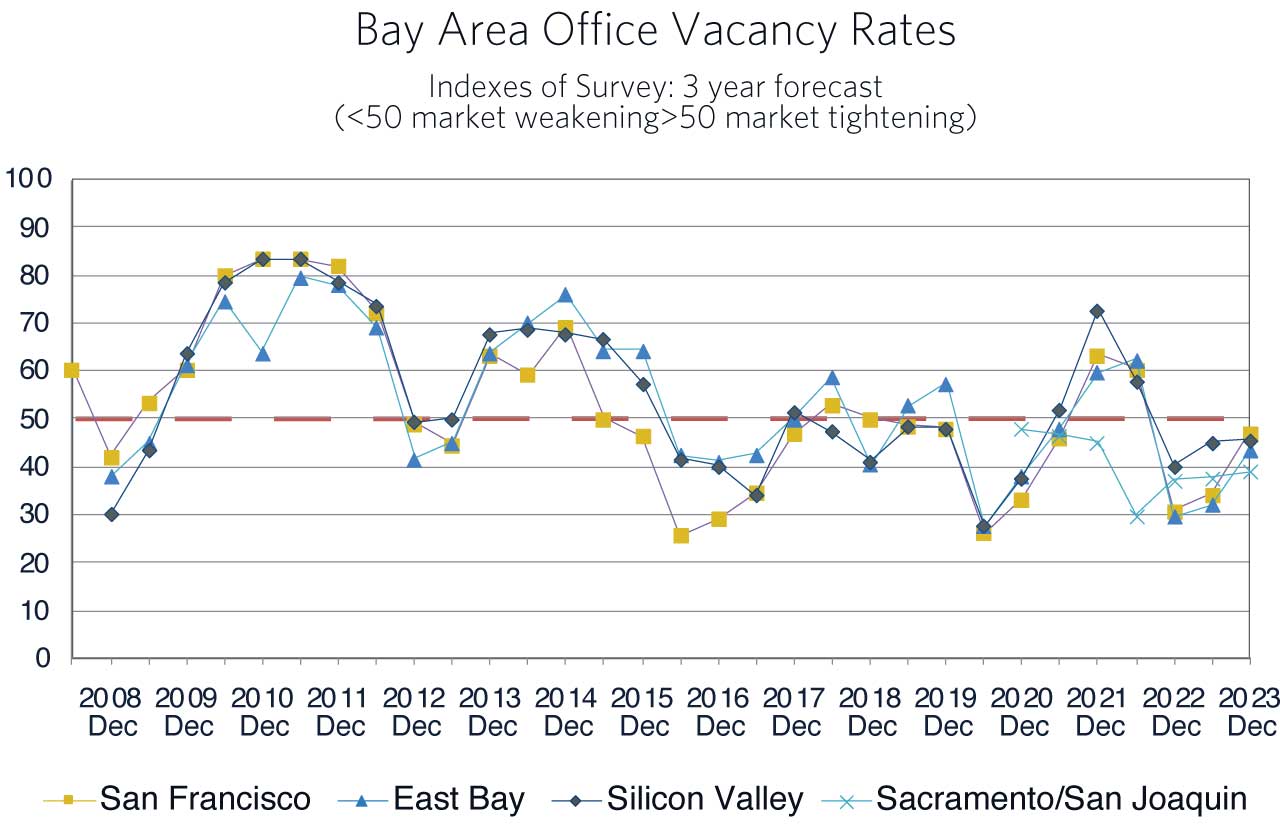

For developers in the office sector, the rationalization of existing office space and a return-to-the-office are going to be key elements in deciding where and when to invest. In the latest Survey, all of the San Francisco and East Bay Panelists, 90% of the Silicon Valley, Los Angeles, Orange County and San Diego Panelists, and 85% of the Inland Empire and Sacramento/San Joaquin Panelists were experiencing slow-walking in the leasing process and/or increased subleasing at their properties. It is not surprising then that for the past 18 months developer sentiment has been pessimistic. Even though the current Survey shows an improvement in sentiment, it remains decidedly negative (Chart 1).

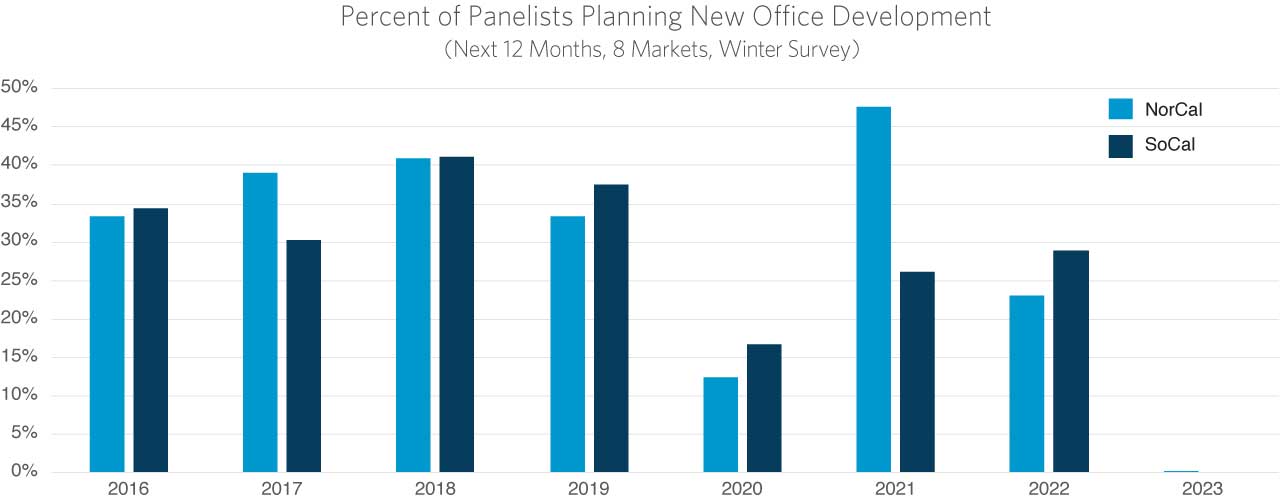

On average, participants in each panel expect both rental rates and occupancy rates to weaken in the coming year and they do not expect a full recovery to current levels before the end of 2026. This portends less new office construction, particularly in the year to come (Chart 2). The forecast is for at least three more years of declining rents and occupancy rates. In NorCal, none of the panelists are planning new projects for the coming year and in SoCal, 83% are on the sidelines. Approximately one quarter of the panelists expect to take some of their office properties out of the market through conversion to alternative uses.

The pessimism is not because office using employment is shrinking. Indeed, payroll employment in office using sectors has grown steadily over the past year. This includes the professional, scientific, and technical services sector, a tech centric sector important for the Bay Area. However, the kinds of jobs that fueled a boom in office leases pre-pandemic are also those most amenable to remote work. This has given rise to vacancy rates of 30% or more in San Francisco and 15% in Los Angeles. As firms bring workers back to the office in a hybrid environment, the amount of space and the configuration required will alleviate some of the uncertainty holding back new development, however the overhang of office building debt likely means that the timing will be similar to the five-year adjustment just finishing in brick-and-mortar retail.

“Interestingly, we’re seeing that the location and the quality of the building seems to be more important to tenants than building specific amenities.”

— Crystal Lofing, Partner, Allen Matkins

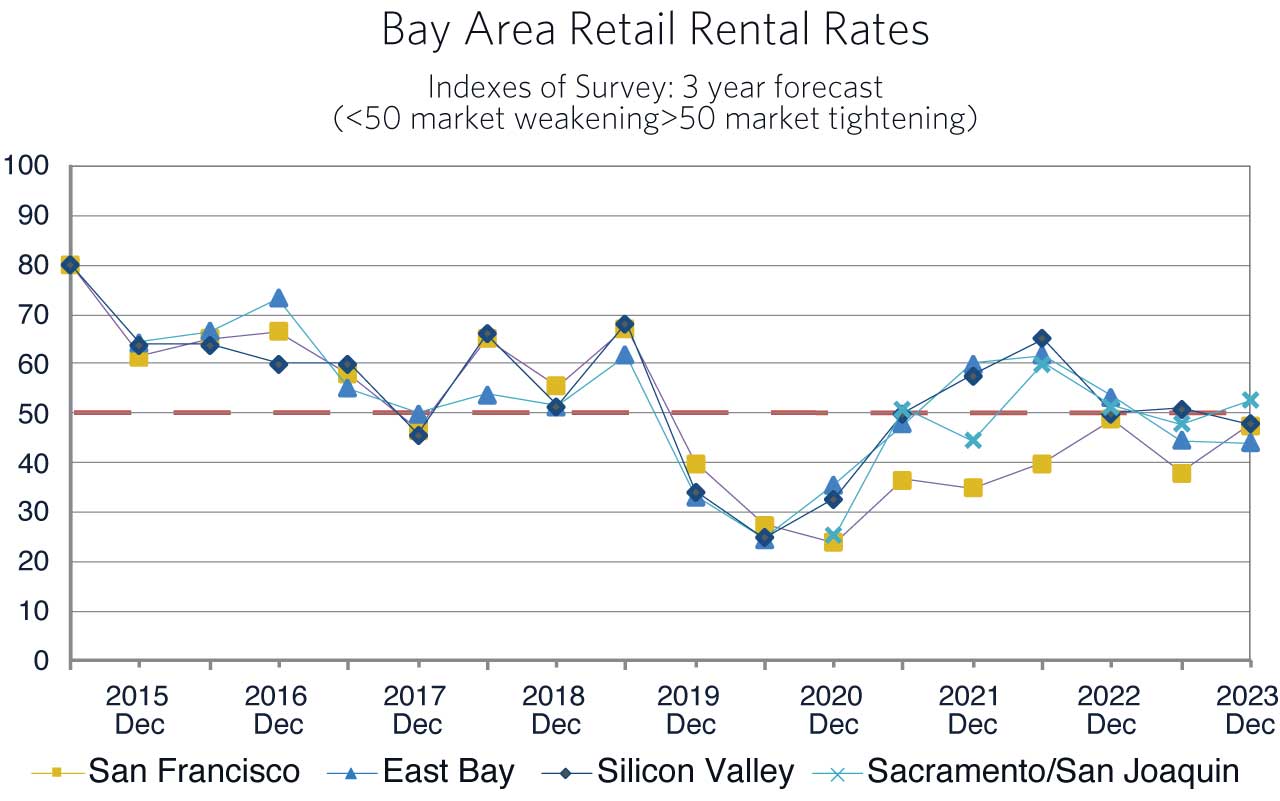

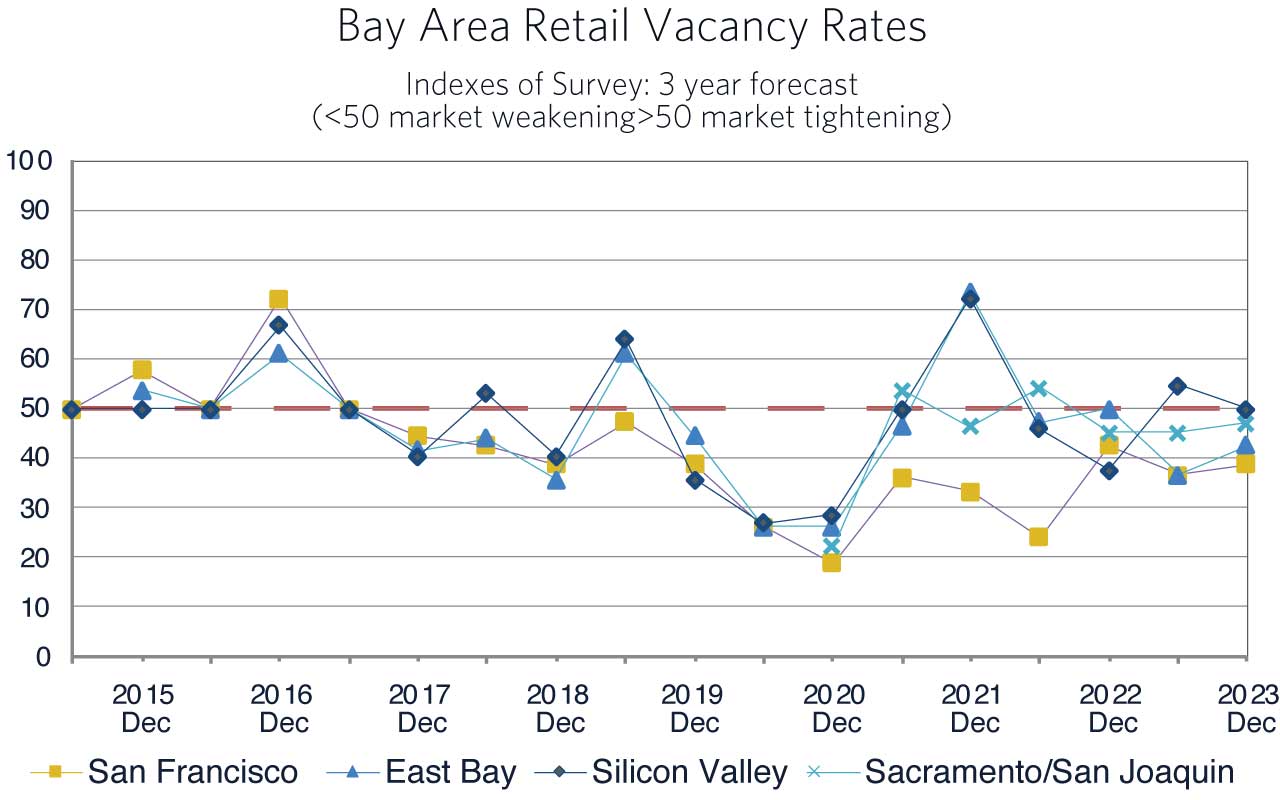

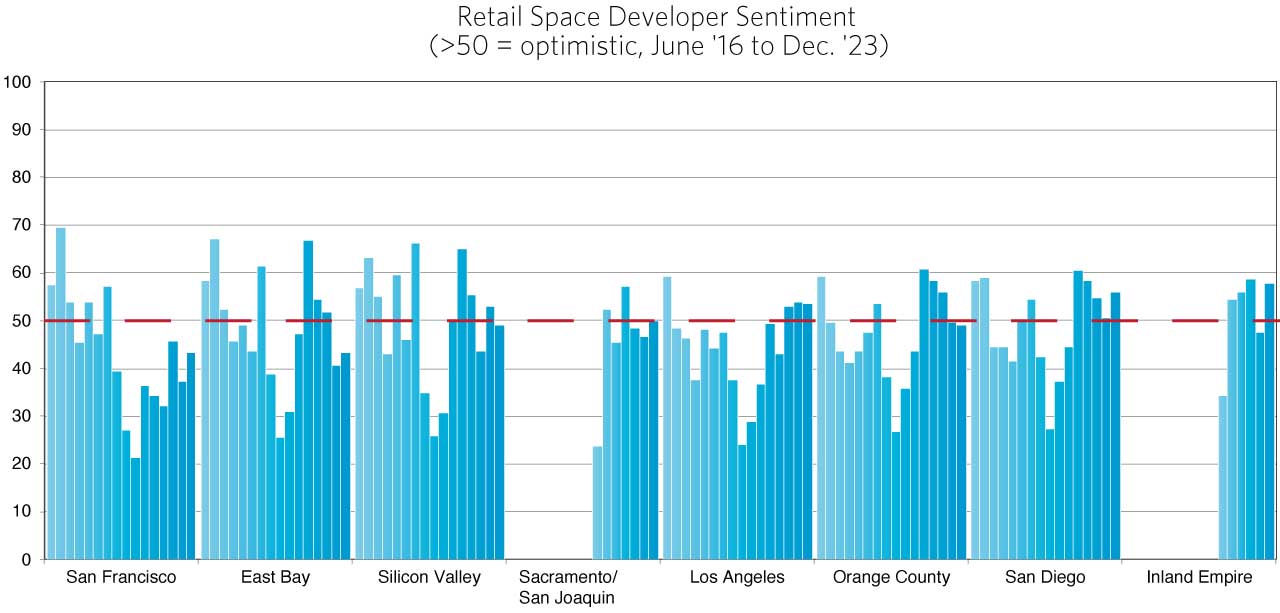

Retail Space Markets

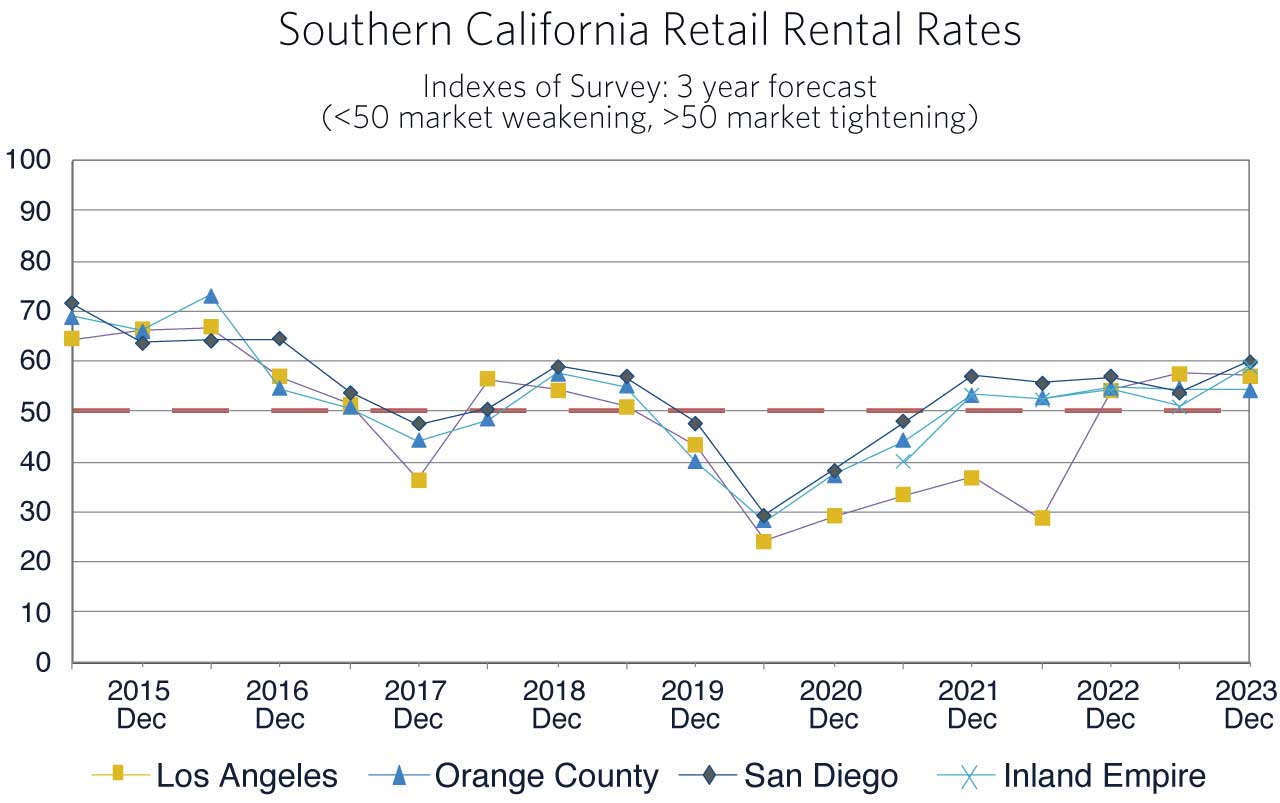

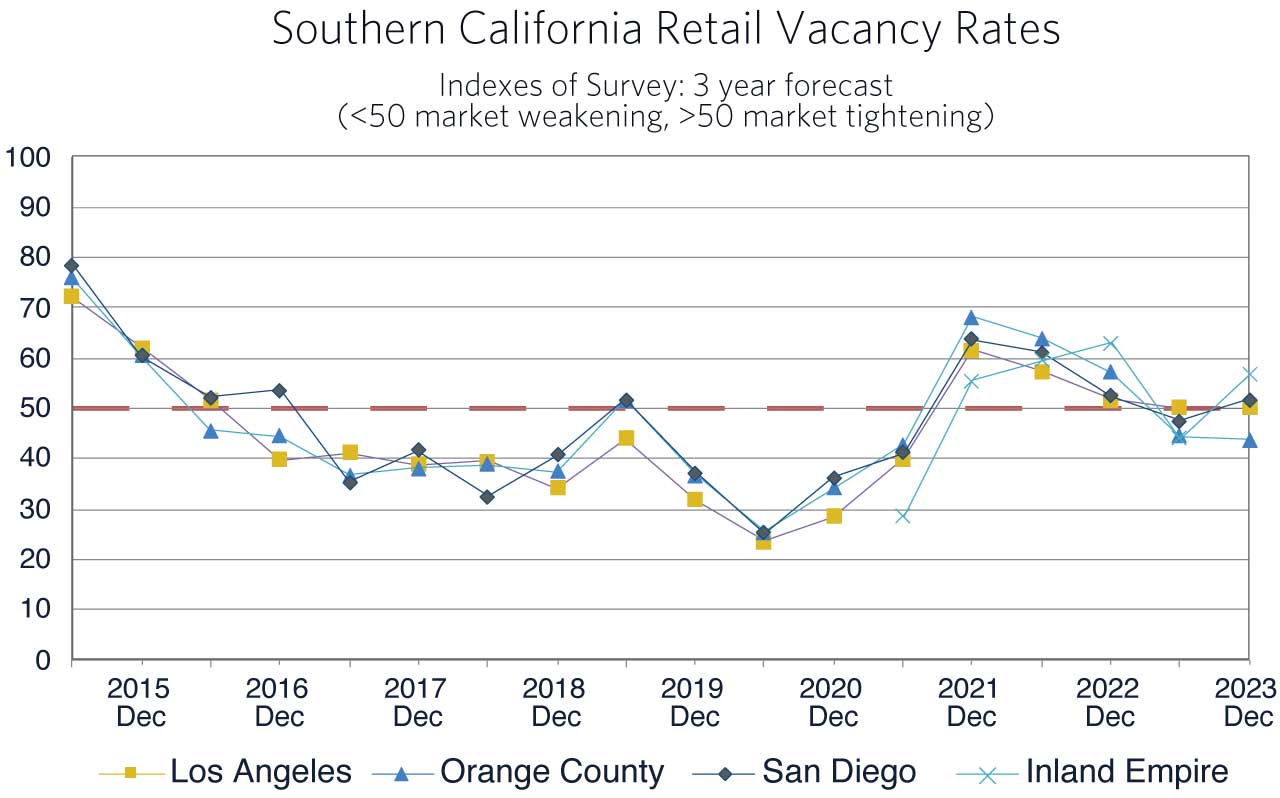

For a year we have asked of the survey data: “is retail poised to come back from the bottom of the cycle?” The survey responses over that time coupled with the bullish responses this winter answer the question with a yes. (Chart 3). There are three important elements in this conclusion. First, the overhang of retail space, while not entirely gone, has been greatly reduced. Second, people want to be back in stores for experiential retail. Inflation adjusted brick and mortar retail sales continue to increase nationwide. Third, the continued building of homes generates a local demand for new retail to support new or expanded residential communities. Though multi-family developers are part of the multi-family panel and not the retail panel, they also indicated that they would expand their retail development footprint as part of mixed-use residential projects.

In three of the four Southern California regions, Los Angeles, San Diego, and the Inland Empire, developer sentiment has moved into optimistic territory, and in Orange County sentiment has moved to neutral. Historically, when the index moves from negative to positive it has been followed by an expansion of new development. Post-pandemic experiential retail as evidenced by the new SoFi Stadium Complex in Inglewood and the development at the Grand Park in Orange County is part of this change in sentiment. The panelists are expecting both an improvement in rental rates and declining vacancy rates over the coming three years. One year ago, nearly 60% of the panelists were on the sidelines. That has fallen to 40% in the current survey, and 88% of the panelists now expect supply to increase less than or equal to the increase in demand.

In Northern California sentiment is increasing, but it is still below an index level of 50 indicating some pessimism. The only market where a neutral sentiment exists is the Sacramento/San Joaquin market. In this market new housing development is a positive factor and extensive work-from-home by state government agencies a negative factor. Overall, for the Bay Area the continuation of high office vacancies and work-from-home has been a drag on retail demand. In spite of this subdued sentiment, the percentage of the panel now planning new retail development has increased to 57%, with 43% of all panelists planning multiple projects (Chart 4). Moreover 80% of the panelists are expecting demand growth at or above supply growth.

“Sub-sectors that are attracting investor and developer interest are areas where people want to go. And one exciting area that I’ve seen in the past year has been growth in historic areas, small downtowns, the so-called old towns of areas where people live as opposed to downtowns.”

— Jonathan Lorenzen, Partner, Allen Matkins

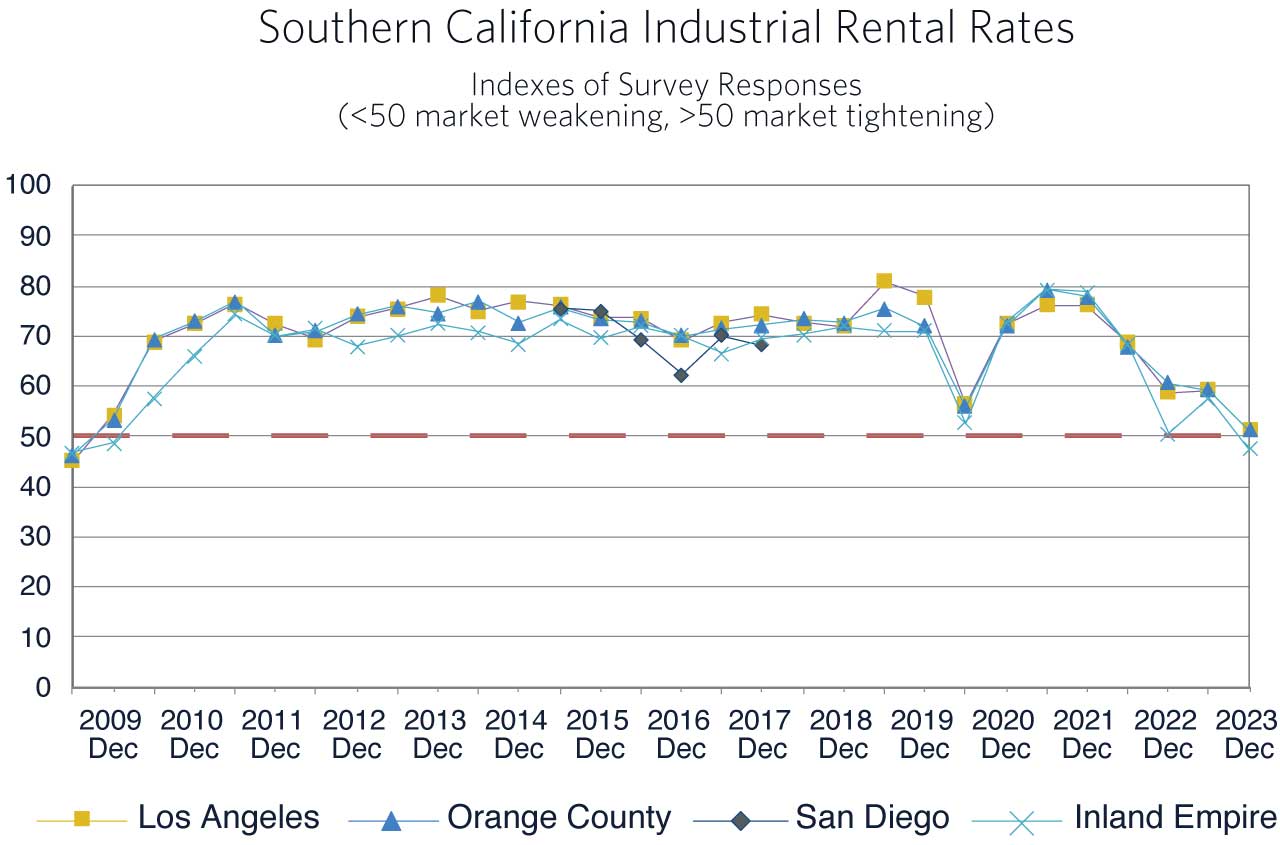

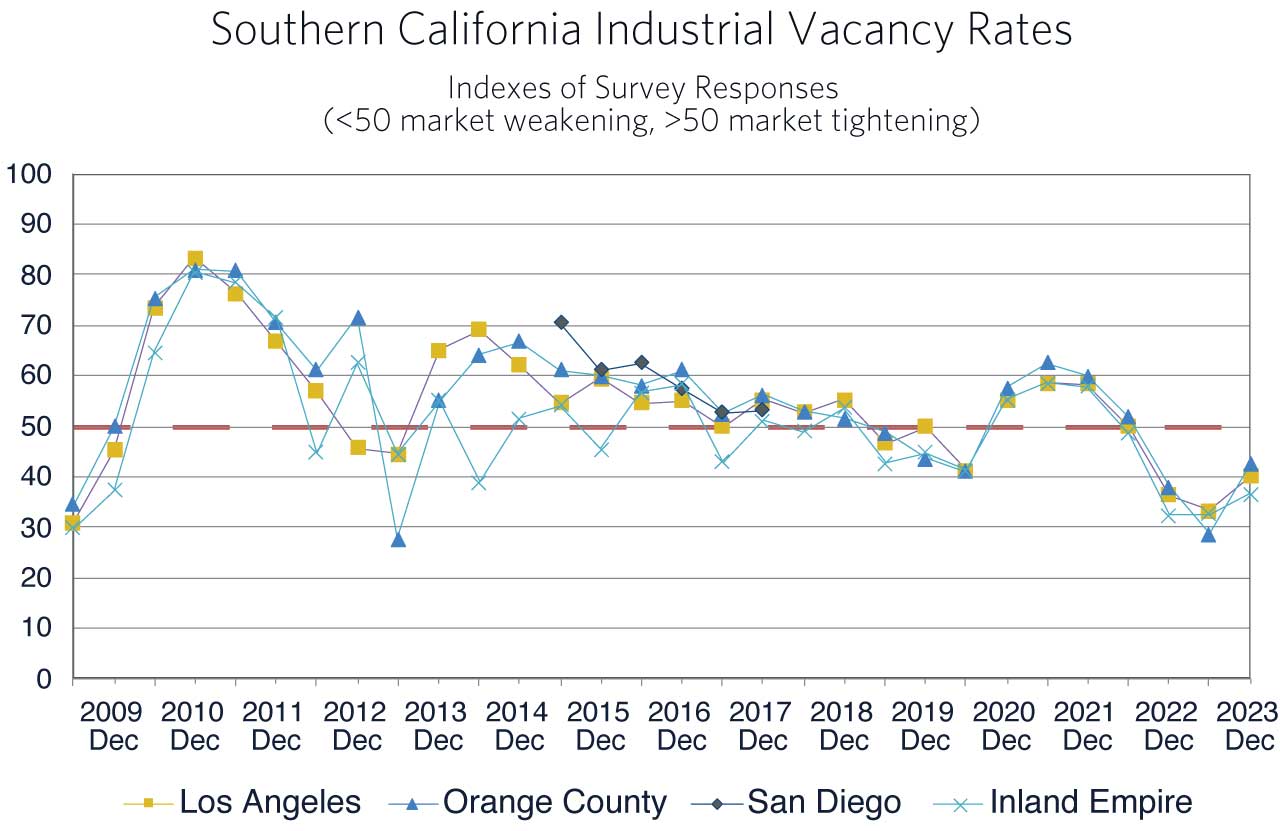

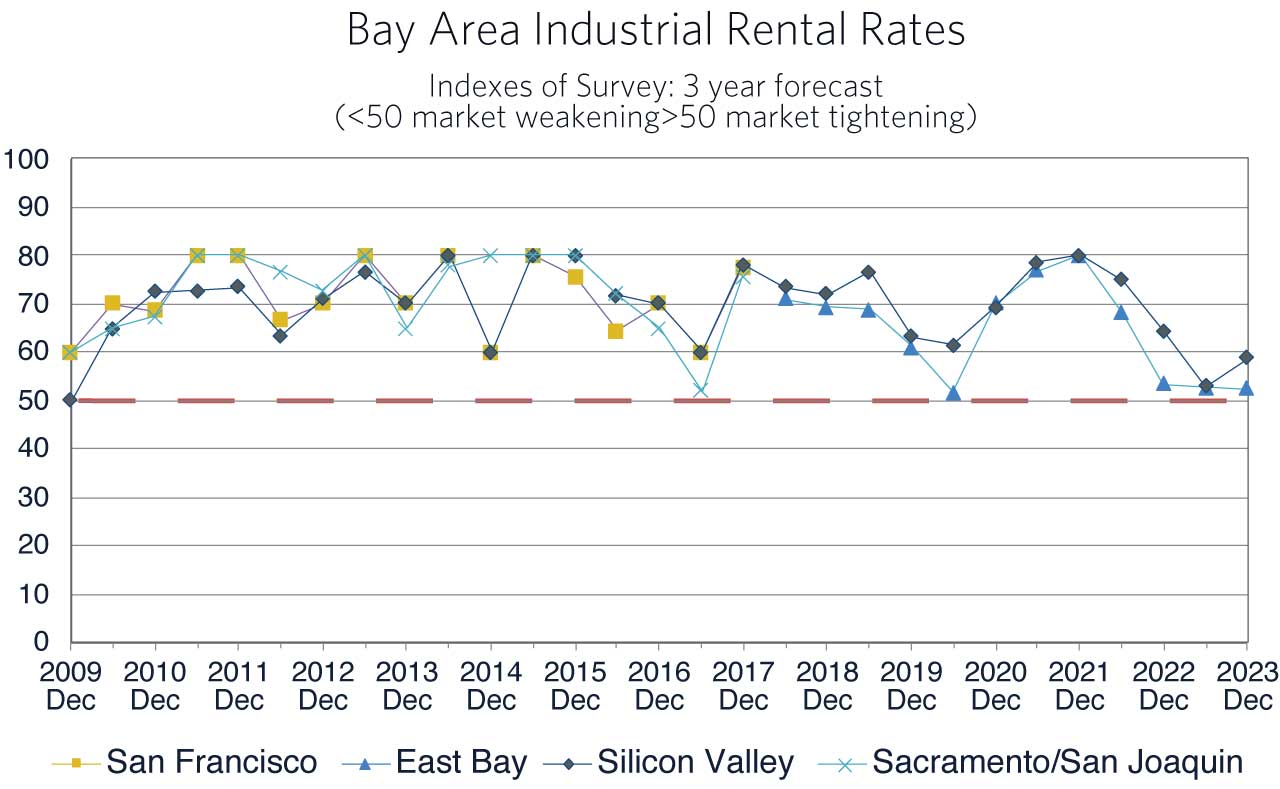

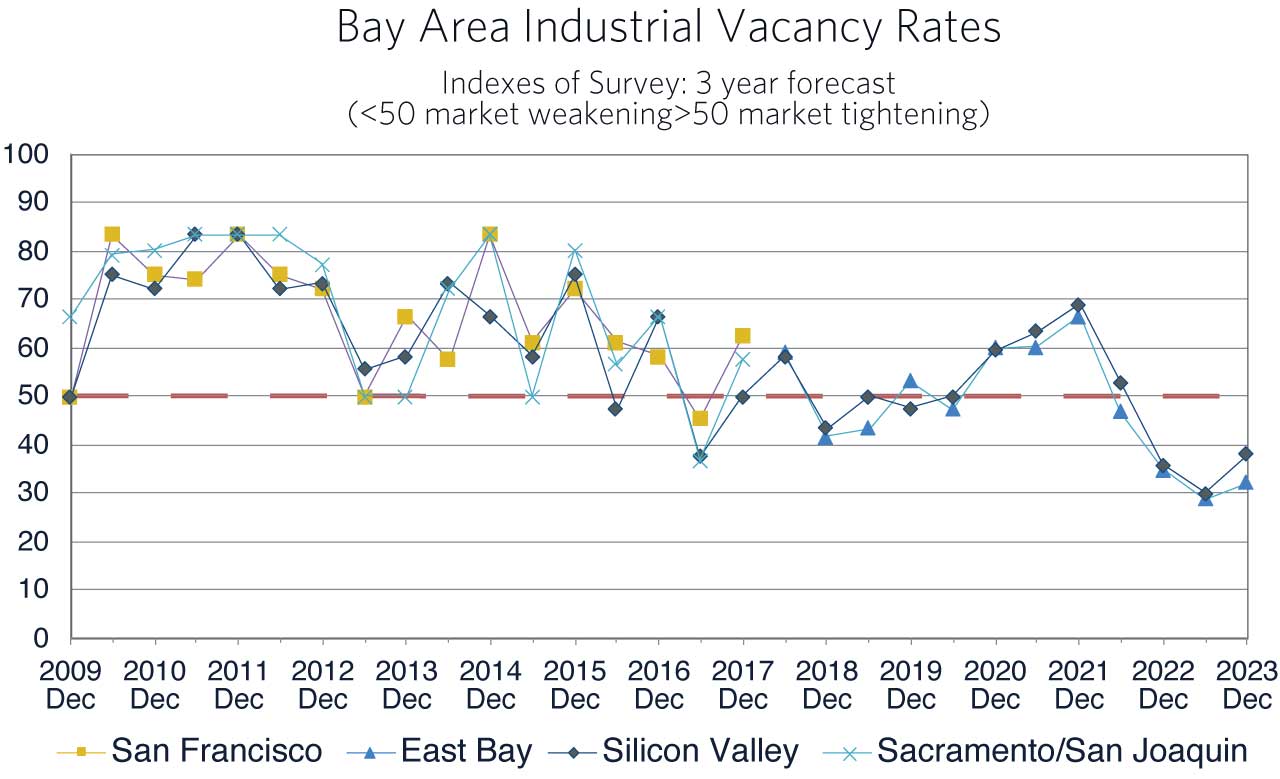

Industrial Space Markets

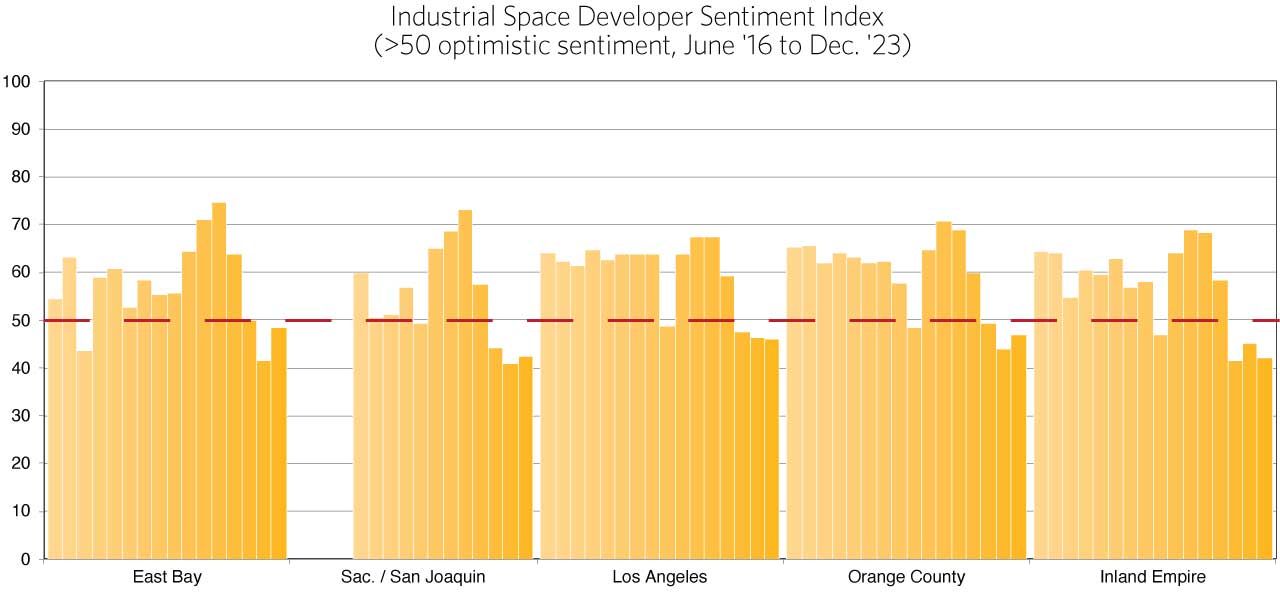

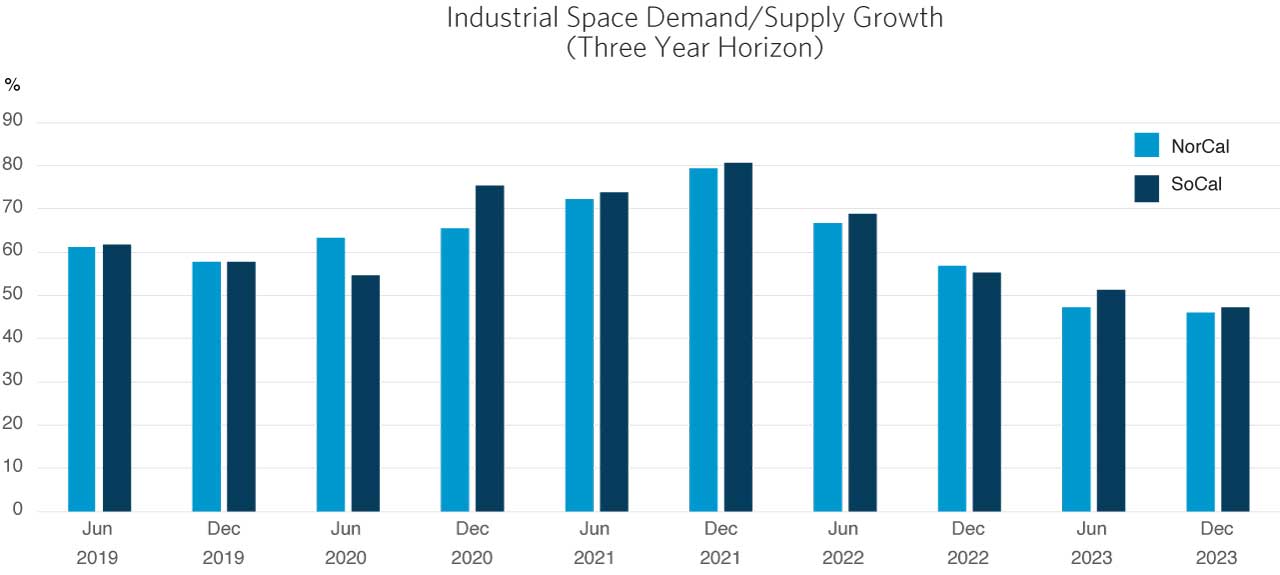

In the commercial real estate realm industrial space was the star performer between 2010 and 2022. In the Winter 2023 Survey however, sentiment turned pessimistic. The current Winter 2024 Survey shows continued negative sentiment in each of the five markets surveyed: the East Bay, Sacramento/San Joaquin, Orange County, Los Angeles and the Inland Empire (Chart 5). Usually such a turn in sentiment portends a cutback in activity, but not always. In a market as hot as industrial space has been these past years, negative sentiment only means that supply is finally catching up with and growing at the rate of demand growth (Chart 6).

In the Northern California markets of the East Bay, San Joaquin County and Sacramento, rental rates are expected to improve over the coming three years. The negative composite sentiment is strictly a function of vacancy rates, currently at very low levels, rising over the same time frame. Vacancy rates have been inching up through the past year but still stand at 3% to 5% for warehouse space. Vacancy rates are higher for factory space reflecting the closing of some San Joaquin County factories, however conversions and construction, including Tesla in Lathrop and Bosch in Roseville, will be adding to factory space absorption over the coming three years. A larger percentage of the panelists are reporting plans to start one or more new projects than were reported in previous Winter Surveys since 2019. The panelists expect demand to continue robust growth with 63% reporting that they expect balanced demand supply growth. However, this is tempered by the 25% that expect supply to grow faster than demand over the next three years (Chart 6).

In Southern California, the landscape looks much the same with sentiment in pessimistic territory due to the view that the sub 2% vacancy rates are fading into the past. In addition, there is an expectation of a slight dip in rental rates in the Inland Empire. Events leading to this sentiment in the Inland Empire are the completion of a large number of new warehouses with many more under construction, and the decline of traffic at the San Pedro Bay ports. Were traffic to pick up and/or some moratoriums on new construction put into place, this forecast of declining warehouse rents would be too pessimistic.

In addition, factory construction in the inland parts of the region, including Palmdale, San Bernardino City and Temecula, will offset some of the slowdown in the construction of warehouse space in the coming three years. The percentage of panelists in the Southern California markets planning on beginning one or multiple new developments in the coming twelve months is at 74% and as with NorCal, at the highest level since 2019. Nevertheless, the expectation is that industrial market demand in SoCal will not exceed the increases in supply through 2026 (Chart 6).

The bottom line for industrial space development is that the building spree is not over yet. Vacancy rates have been extremely low due to the fast growth in demand through the last economic expansion and the pandemic, and markets are just beginning to catch up. The UCLA Anderson Forecast has positive but slow economic growth this year returning to trend in 2025 and thereafter generating increased demand for imports. With the Panama Canal route fraught with climate change induced congestion and an end to the labor actions that have worried shippers to West Coast Ports, support for continued development, albeit with reduced intensity as indicated by the survey, remains.

“As online shopping, and especially same-day and overnight delivery service, continue to expand in popularity, infill development projects will become an even bigger component of the growth of the industrial market.”

— Drew Emmel, Partner, Allen Matkins

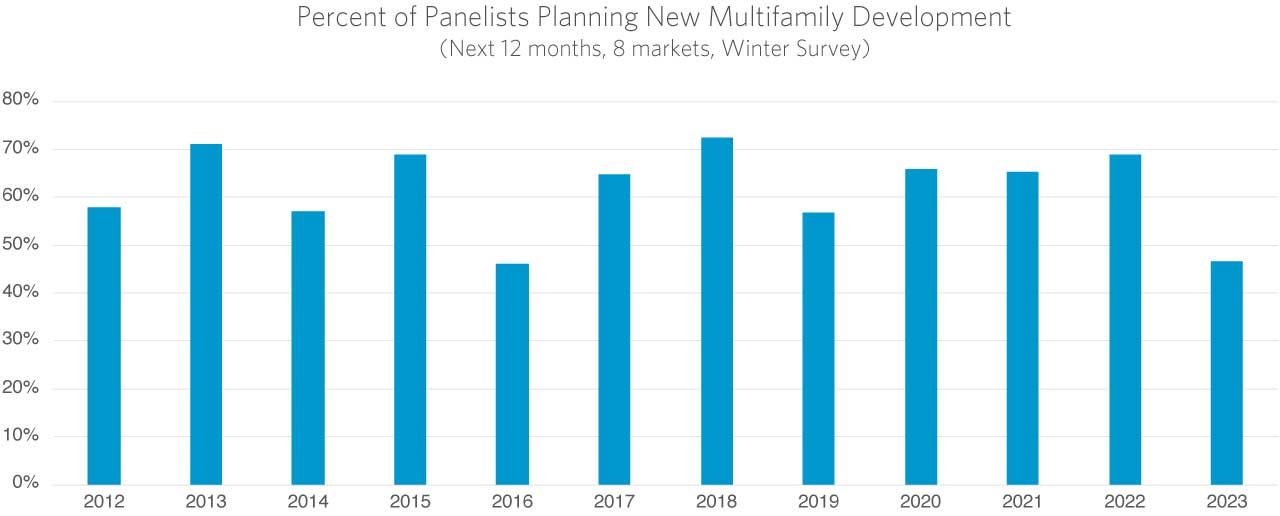

Multi-Family Housing Markets

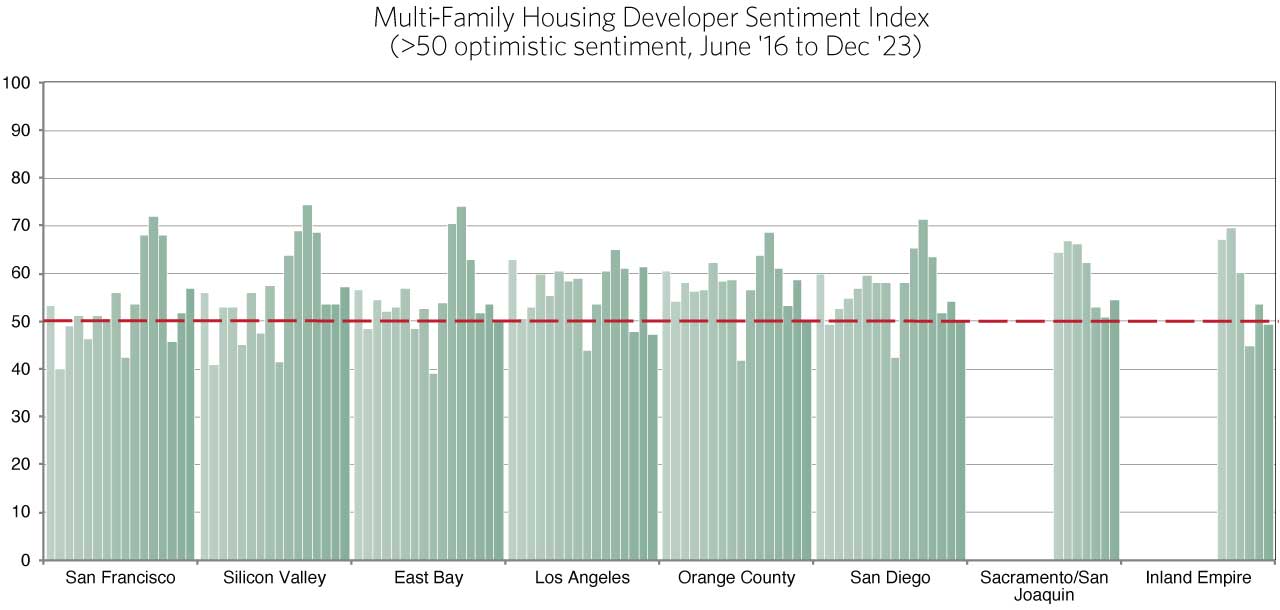

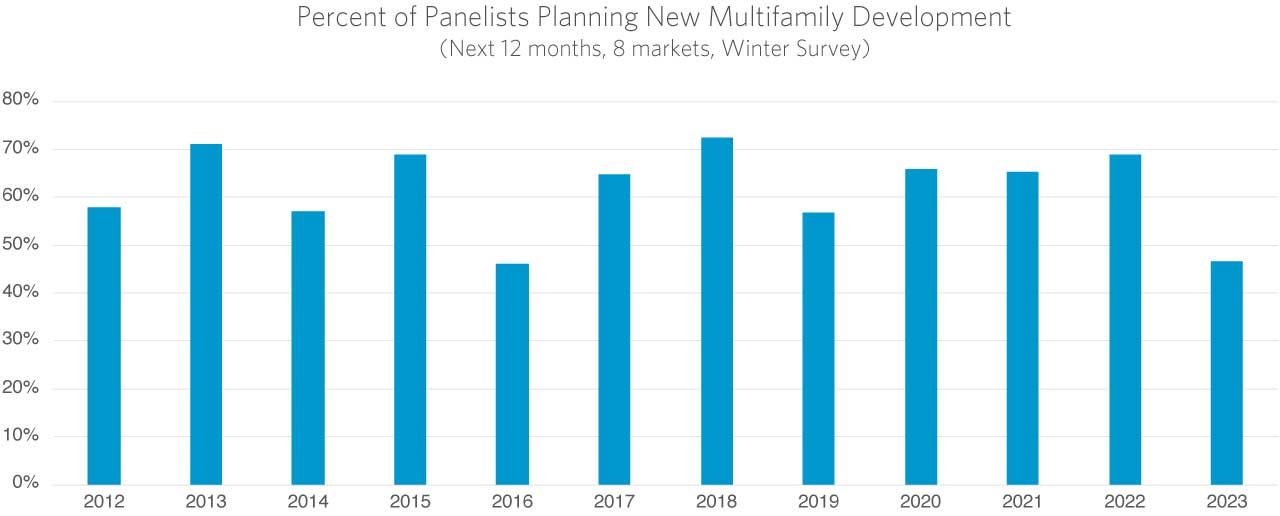

Even though rents have softened in the Bay Area, the multifamily panels in each market are bullish about the coming three years (Chart 7). This turn in the market is particularly pronounced in San Francisco with new city policies in place, the rise of its AI-tech industry and a discernible move back into the city. Even though the expectation is that Northern California multi-family housing is about to experience a growth cycle, the highest percentage of panelists since the Survey began in 2012, 68%, are not going to develop any new properties in the coming 12 months. This is the same pattern that the retail space market exhibited just before the turn in new development this year.

In Los Angeles, the Inland Empire, and Orange County the panelists expect vacancy rates to edge up and rental rates to increase more rapidly than inflation over the next three years. Overall, sentiment is subdued and the percentage of panelists beginning new developments has fallen to 55% (Chart 8). Higher interest rates and the rental rate increases that slowed in 2023 have weighed on new home construction. In addition, tightened lending standards including a greater equity participation on the part of developers has reduced current plans.

There has been some pull back in development in California this past year as has been the case across the nation. However, the reduction in new development has been less acute in the Golden State. There are two additional factors driving new multifamily development in the 2023-2026 period. First, the inland parts of the state have been experiencing growth in logistics and infrastructure construction. Second, a series of state laws -- SB8, SB9, and SB10, and AB2011, AB2097, and AB2234 -- superseded some local building approval processes, opened land currently zoned for single-family homes to the construction of small multi-family structures, and have reduced barriers to multi-family construction in transit corridors. Although these will be significant factors for the out-years of the Survey, the current financing issues have resulted in the number of new multi-family units permitted decreasing by 1.5% during the first 10 months of the year. The current Survey is yielding a prediction of relatively little growth in multi-family development in 2024 followed by a return to an expansion of development thereafter.

“In 2024, we expect to see the largest wave of new multifamily supply coming online since the 1980s. However, this trend is not expected to continue as construction starts are anticipated to rapidly slow down this year. Strategically, for clients with existing real property holdings and access to competitive debt funding capital, it could be an opportune time to advance development due to reduced competition.”

— Jennifer Jeffers, Senior Counsel, Allen Matkins

The Survey In Perspective

The Winter 2024 Allen Matkins/UCLA Anderson Forecast California Commercial Real Estate Survey was taken as the economy was coming off a quarter in which GDP growth bounded up to 5.1% and commercial real estate development, in the aggregate, expanded. Our Survey respondents, while generally positive about the coming three years, were concerned with increasing financing costs. Nevertheless, industrial markets, which continue to experience historically low vacancy rates, remain poised for a good run of new building and superior returns. Multi-family housing sentiment remains positive though significant new development is not expected until 2025 and 2026. The current turn in sentiment for retail will now result in significant new building in the near future. Office markets have a long road ahead as both vacancies and financial overhang require adjusted asset values before a significant increase in new office development will take place. If the recent retail space history is a guide, this process will require time beyond the 2026 horizon of the current Survey.

“With a significant portion of the office market continuing to underperform, there is increased focus on the conversion of older and obsolete product into more productive uses such as housing or mixed-use facilities. While the financial aspect of adaptive reuse projects remains a key challenge in 2024, we expect to see a growing emphasis on the conversion of office buildings to uses that better support local economies in the coming years, in California and throughout the country.”

— John Tipton, Partner, Allen Matkins

“Industrial markets, which continue to experience historically low vacancy rates, remain poised for a good run of new building; multi-family housing sentiment remains positive though significant new development is not expected until 2025 and 2026; the current turn in sentiment for retail will result in new building in the near future; and office markets have a long road ahead as both vacancies and financial overhang require adjusted asset values before a notable increase in new office development will take place”

— Jerry Nickelsburg, Director, UCLA Anderson Forecast