Summer 2020 Survey

Welcome to the latest edition of the Allen Matkins/UCLA Anderson Forecast

Every economic recession is a little bit different. In 1990 it was the aerospace contraction after the end of the Cold War, in 2001 it was the dot-com bubble, and so on. When they occur, it is common to think, “this time is different,” and invariably, that notion turns out to be incorrect. However, the 2020 recession is indeed different. Today we are faced with a pandemic-induced recession in which a public health crisis, rather than an imbalance between demand and supply, has resulted in a reduction in aggregate demand. Statistical forecast analysis has as its basis the proposition that past statistical relationships hold into the future. A knowledge of those correlations, current data, and perhaps some assumptions about data not yet known, lead to the forecast. Today, the ability to use past data to forecast into the future is more limited than before. However, forward-looking surveys such as the Allen Matkins/UCLA Anderson Forecast California Commercial Real Estate Survey, taken contemporaneously, can enrich our understanding and projections.

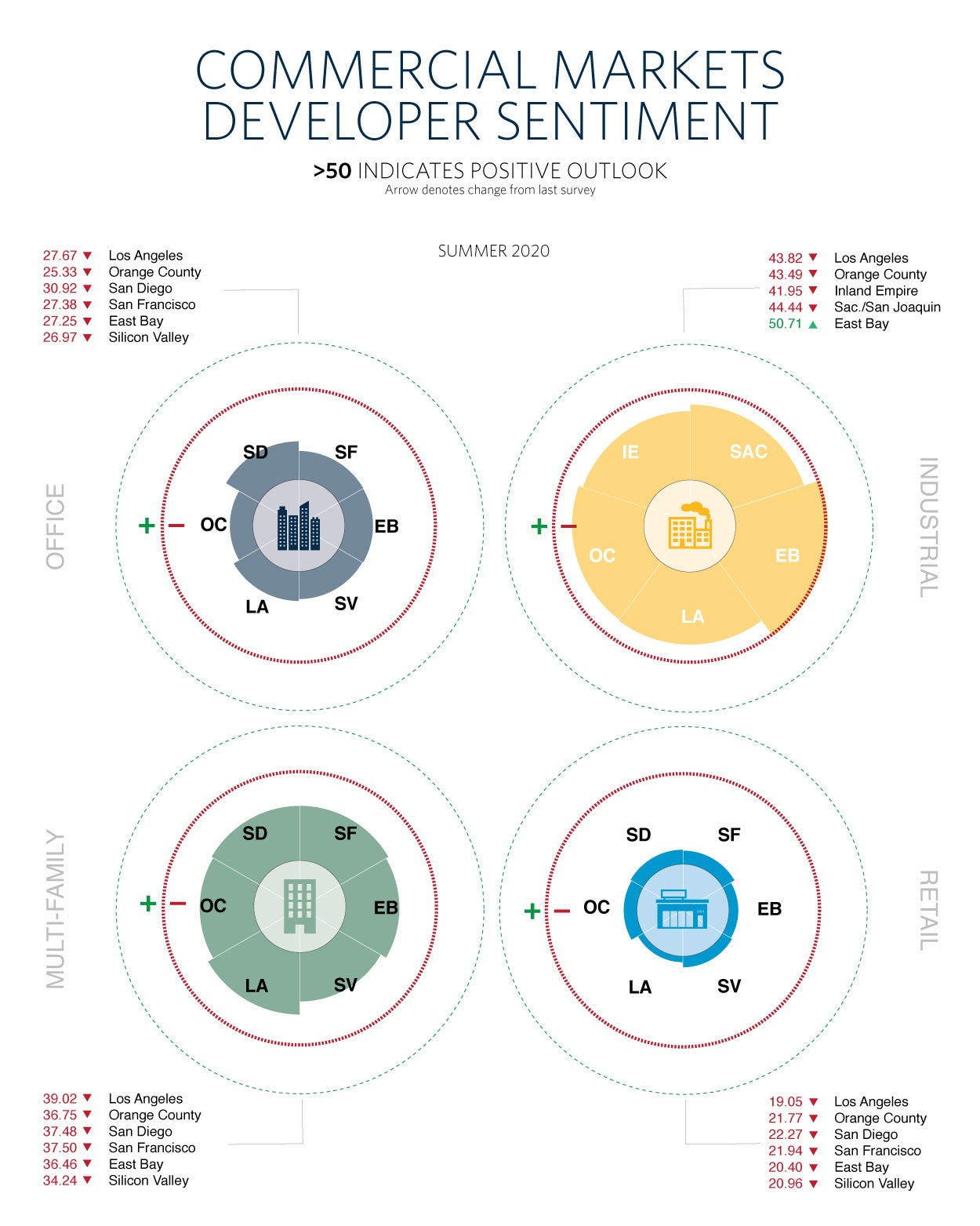

The Allen Matkins/UCLA Anderson Forecast California CRE Survey has a rich set of questions such that indirect qualitative inference can be made. For each of the four CRE spaces surveyed -- Office, Industrial, Retail, and Multi-Family Housing -- we find that the recession has created uniform pessimism. In spite of that pessimism, the trends observed in earlier Surveys have continued into this recession and are expected to continue right into the coming expansion. That is, some trends will accelerate and there is more uncertainty, but there are also no big surprises from the Summer 2020 Survey.

The Allen Matkins/UCLA Anderson Forecast California CRE Survey compiles the views of commercial real estate developers with respect to markets three years hence. The three-year time horizon was chosen to approximate the average time a new commercial project requires for completion (though projects with significant environmental issues often take much longer). The panelists’ views on vacancy and rental rates are key ingredients to their own business plans for new projects, and as such, the Survey provides insights into new, not yet on the radar, building projects and is a leading indicator of future commercial construction. For example, if a developer were optimistic about economic conditions in East Bay’s industrial market in 2023, then initial work for a new project with an expected ready-for-occupancy date of 2023 — a business plan, preliminary architecture, and a search for financial backing — would have to begin no later than the latter part of 2020. Although optimism does not always translate into new construction projects, this sentiment is usually a prerequisite for it. Multi-family housing and industrial space provide a counterpoint to this as discussed below.

Office Space Markets

In our recent surveys of office market sentiment, we deduced that a peak of the market had been reached. Over the last 30 months, the sentiment index fluctuated about the 50 level for each region surveyed. Fifty is the value dividing between a majority of the panelists being pessimistic and majority of them being optimistic. Data on slowing growth in tech-intensive/office-using employment supported this sentiment result. The expectation from the office market sentiment index was for a slowing in the amount of new office space reaching the market over the coming three years.

That occurred leading up to the current recession. Now there are important questions affecting today’s outlook. Will the experience of working from home allow firms to demand less office space? On the surface, the answer is yes. Under the surface however, it is not all that clear. The idea of hot-desks -- ones with multiple users -- becomes less attractive. Corporate culture, on-the-job training, socially-induced creativity, and company socialization suggest no. How does a new hire understand the company and learn from others, and how does a supervisor understand the new hire’s work ethic and innate productivity? The answer is not two hours per day on Zoom, BlueJeans, or other webinar platforms. It is only those jobs that in part or in their entirety never needed to be in the office in the first place, those that are measured solely by output, that seem to be realistic candidates today. And, even then, knowing the staff and understanding the company’s goals and requirements might matter. Nevertheless, this remains an open question, particularly with new technologies for working-from-home being developed.

Secondly, there is the question as to who is hiring today and who will be hiring tomorrow. Today’s answer is tech and finance. Tomorrow’s answer includes healthcare. This gain in office-using employment will be offset somewhat by management of chain retail establishments, professional and business services, and education services requiring less space. However, on balance, at least in California, the longer-run outlook for office demand is not disastrous. With these notions in mind, how did our panelists react to the recession and what was their outlook for office markets over the next three years?

The latest Survey looks much like the December 2008 Survey. This is not surprising as both were taken during the height of an implosion in economic activity. Our panelists’ shared sentiment is about as gloomy as it was then. They see rising vacancy rates and downward pressure on rents over the next three years. This is consistent with the UCLA Anderson Forecast’s projection that a rapid return to pre-recession office-using employment is not likely.

The implication of the drop in sentiment is, as in 2008, a continued decrease in new office construction over the ensuing three years. Although half of the Bay Area and Southern California panelists said their plans for the coming 12 months were unaffected by the pandemic, one-third are ramping back development by more than 15 percent from their previous plans. Overall, 75 percent of panelists expressed some stress with current tenant leases. For the one-third that will engage in some new development, the panelists in each market believed that land, building materials, and labor costs would be more favorable. Given the uncertainty about office space demand, these responses seem reasonable and indicate growth in development beginning in late 2021 and a slow return to pre-recession levels.

Retail Markets

During the previous economic expansion, retail space struggled. The current recession tripled down on that struggle. First, household loss of income and shelter-in-place policies reduced current demand for brick-and-mortar retail. Second, the inability to physically frequent many retail establishments created a new set of online shoppers. Third, increases in the savings rate on the part of households in response to the recession portends less consumption. To be sure, some activities will return, particularly personal services and experiential retail. However, marginal properties will not find tenants willing to pay sufficient rent to keep the properties in the retail space.

The pessimism expressed in the latest Survey by panelists from the Bay Area and Southern California is an extension of the trends from the past three years. The current view is that retail properties will be generating significantly lower, if any, returns in 2023 compared to the middle of 2020. In the Bay Area and Southern California, two-thirds of panelists will not develop any new properties in the coming 12 months. Approximately the same percentage expect difficulty with current leases and expect plummeting property values.

Overall, this is not good news for retail property markets. However, it does not mean the absence of solid targeted opportunities. Indeed, 39 percent of our Bay Area panelists began new retail development or re-development projects in the last year and 34 percent expect at least one new project this year. As for Southern California panelists, the numbers were similar, 36 percent and 34 percent, respectively. Overall, the level of new retail property construction is expected to significantly decline from 2019 through 2023.

Industrial Space Markets

Industrial markets over the past several years have seen consistently high occupancy and superior rental rate growth. Sentiment expressed in our latest Survey dropped precipitously in all markets except the East Bay as you can see in the industrial developer sentiment index chart. On the surface, that seems logical. We are in a deep recession and pessimism about the coming couple of years is the order of the day. However, other indexes from the Survey tell a much more nuanced view of industrial space markets.

Our panelists were asked about the changes in the demand for industrial space, primarily warehousing, and the expected increase in the stock of space available. The chart below shows the responses for Southern California over the past two years. A value higher than 50 indicates that the panelists expect the demand for space to increase faster than the expansion of available space. To be sure, there is a downward trend in the index. However, even in the latest survey when panelists stated that their expectation, on average, was for markets in 2023 to be worse than they are today, there is no expectation of excess supply.

Their actions also indicate that they are not as pessimistic as the overall index suggests. Sixty percent of the panelists in Southern California and 43 percent in Northern California are planning at least one new development in the next 12 months, and 39 percent and 29 percent are planning multiple projects respectively. When one considers that this is in the middle of a recession with a great deal of overall economic uncertainty, these numbers are quite telling.

The reconciliation of this data stems from the following observation: recently, industrial markets have had robust growth in value. With an increase in household saving, a recession, and a continued trade war with China, there will be near-term downward pressure on rental and occupancy rates. However, this is from a very high level. If the demand for warehouse space and the stock of warehouses are increasing at about the same rate as projected, then 2023 will see a mild erosion of rental rates when adjusted for inflation, and there remains the possibility of some erosion in occupancy. However, that does not mean that industrial space markets will be depressed, rather that they will not be as imbalanced as in recent years.

Multi-Family Housing Space Markets

In the December 2019 analysis of the multi-family housing market, we commented on the disparity between optimism in Southern California and pessimism in the Bay Area by stating that, “the Southern California markets look to continue their building boom, while the Bay Area markets, now that rent control has more certainty to it with AB 1482, ought to see an increase of the amount of new multi-family construction.” The pessimism that comes with the recession hit all multi-family markets equally, but the disparity, at least as reflected by the composite sentiment index, is no longer.

For the aggregate of the regions surveyed, the average percentage of developer/operator panelists who are not going to start a new project in the next 12 months, either because they are fully booked with ongoing construction or because they do not see a lucrative opportunity at the time, is 37 percent. The average from 2012 to the present is 35 percent, not statistically different. The pessimism in sentiment, that rental rates and occupancy will not be as good as they are at present, has not affected the rate of activity by developers. A year ago only 13 percent of the panelists in the Bay Area stated that they would have more than one new development. However, in the past year, half of them ended up beginning more than one project. This is consistent with our analysis at the time, that uncertainty with respect to rent control was weighing on developers in the most expensive rental markets in the state, and the resolution would result in an increase in multi-family construction.

As the economy grows, the demand for housing in the Bay Area and Southern California will grow alongside it. Though the UCLA Anderson Forecast is looking at a 30-month recovery in the state, and there remains a great deal of uncertainty with regard to the current public health crisis, the market for multi-family housing remaining robust seems likely. Indeed, in spite of the turn-around in sentiment from each of the six panels, almost three-fourths of the Southern California panelists and two-thirds of the Bay Area panelists stated that the pandemic had either not changed their plans for future activity or increased it.

The nature of this pandemic-induced recession has broken the statistical link between the sentiment index and panelist development plans. However, responses to other Survey questions suggest that the overall sentiment index for multi-family housing should be at least at the 50 level. The lack of overbuilding, a decline in costs for labor, land, and materials, the availability of financing at relatively low interest rates, and the panelists’ stated future development plans is consistent with the implied lower stream of revenues still generating sufficient returns to this type of investment. Thus, we expect to observe a quick turnaround in this sector’s sentiment with the December 2020 survey.

The Survey in Perspective

The 20th Century economist A.C. Pigou, who studied sentiment during business cycles, said, “The error of optimism dies in the crisis, but in dying it gives birth to an error of pessimism. This new error is born not an infant but a giant.” We see that for the top-line sentiment of our panelists, but individually they see the same opportunities, or lack thereof, today as they saw pre-recession. Part of the Survey’s power is the variety of questions that allows for an inference with respect to new commercial construction and the state of the market three years hence.

The most interesting conclusion from the current Survey across all regions and all markets, except for retail, is that it is not as bad as it feels. Thus, our prediction of slowing, but not declining, office development, continuing hot industrial and multi-family markets, and a continuing decline in retail properties from recent pre-recession surveys holds through the pessimism expressed in this Survey. As the recession ought to be short-lived, and barring a double-dip recession associated with measures to counter a lingering pandemic, we ought to see top-line sentiment at the end of the year more consistent with the detailed results of the current Survey.